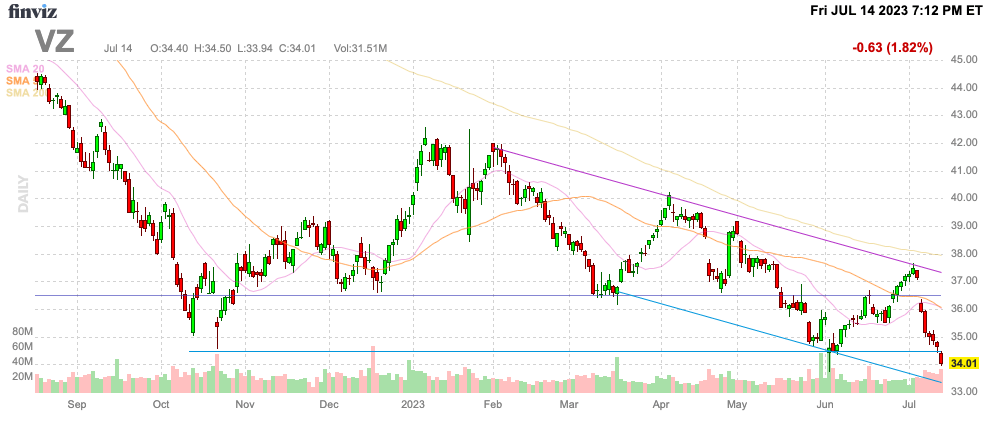

The WSJ report on toxic lead cables was the last thing Verizon Communications (NYSE:VZ) needed. The wireless company no longer has a huge margin of safety and a large liability further perpetuates the debt problems. My investment thesis remains Neutral on the stock with Verizon hitting new lows while the large dividend helps offset the capital losses.

Source: Finviz

Toxic Cable Liabilities

The Journal’s investigation released last week suggests the telecom giants from AT&T (T) to Verizon to Lumen Technologies (LUMN) could face huge liabilities for toxic lead cables left in the ground, under the water and on overhead poles. The report suggests that more than 2,000 lead-covered cables could exist with dozens of tests revealing lead leaching exceeding safety recommendations set by the U.S. Environmental Protection Agency.

The scary part for the stocks is that not only do the companies know about the potential danger of lead-sheathed cables, but also Verizon still claims a lot of these cables are still used in current networks. The company made the following statement to the WSJ:

There are many lead-sheathed cables in our network (and elsewhere in the industry) that are still used in providing critical voice and data services, including access to 911 and other alarms, to customers nationwide.

In this case, Verizon would face liabilities from the toxic cables, plus the costs to remove the cables and the costs to replace those cable with new fiber lines. Though, the most concerning part is that the telecom companies have apparently long acknowledged the toxic lead issues with the cables without doing anything to resolve the problems from cables laid back my Ma Bell in the 1800s up till the 1960s.

Source: WSJ

The big question is the legal liabilities faced by the industry. The companies don’t disclose the amount of toxic lead cables, but New Street Research analyst Jonathan Chaplin suggests the costs could amount to $59 billion to remove all the lead cables nationwide.

The WSJ research suggests AT&T faces the biggest risk with the most cable in the ground followed by Verizon. Of course, all of this is just a rough estimate considering the telecom industry hasn’t provided any detailed reports on the lead-based cable networks, including the ones still in work requiring modern replacement cables.

The fact AT&T was already required by courts to spend $1.5 million to remove 2 cables in Lake Tahoe isn’t a good sign for the industry. The stock was downgraded to Neutral by JPMorgan on Friday partly over of this issue:

Potential copper lead sheathing liability is unquantifiable at this time, but will be a substantial long-term overhang on AT&T and the industry

Limited Margin Of Safety

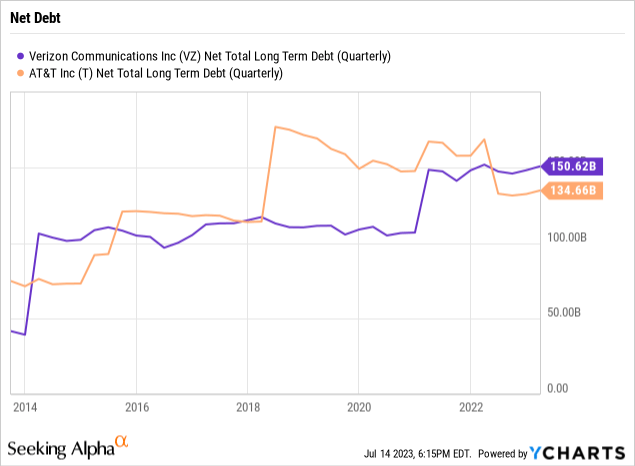

Investors have long overlooked the large debt levels of the telecom giants due to the decent leverage levels. The companies have always had the cash flows to handle the debt loads, but the biggest risk is a scenario where unexpected costs wipe out, or just reduce cash flows.

Verizon has now seen net debt soar to $150.6 billion due to heavy spending on new 5G spectrum and capex. Even AT&T still has a ton of debt despite selling off assets to reduce debt loads.

The inability of the wireless giants to pay down debt over the last decade has been a huge negative for the stocks. Even worse, the shareholder base demands large dividend payouts that contribute further to the inability to repay debt loads leaving the companies susceptible to black swan risks.

Verizon forecast 2023 free cash flows in the $17 billion range based on a capex reduction of $4 billion offset by higher interest expenses boosting free cash flow by $3 billion from the $14 billion level in 2022. The wireless giant spends ~$11 billion annually on dividend payouts leaving only $6 billion in excess cash this year despite the jump in free cash flows from reduced capex spending after the extra C-band costs.

The company is left with limited margin of safety for a toxic-lead liability on top of the large removal costs. Of course, Verizon and other industry participants have previously denied any need to remove old cables, but the WSJ report would sure support a case for elevated lead levels in water and soil samples necessitating work by the industry to resolve the issue before health problems start popping up.

This toxic cable issue only adds to fears of never ending spectrum costs and competitive threats from Amazon (AMZN) entering the 5G wireless space with a partnership with DISH Network (DISH). Either way, Verizon is struggling to grow and a big liability/cost becomes a major problem for the investment and probably explains why the stock just crashed to new lows.

Takeaway

The key investor takeaway is that normally large corporations shake off liability fears due to strong balance sheets. Verizon isn’t in this position anymore and research appears to support a major problem brewing for the telecom sector where the failure to act on prior knowledge of lead cable issues could lead to significant liabilities and removal costs.

Read the full article here