Thesis

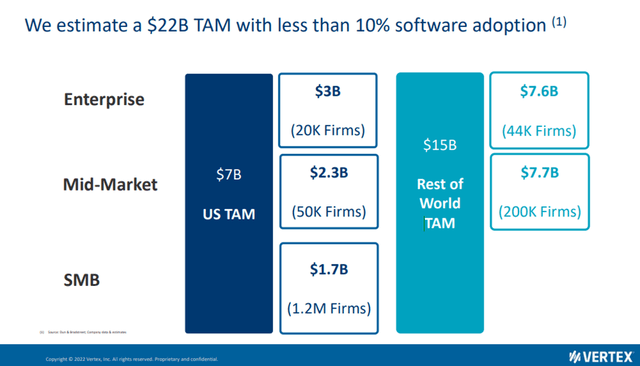

The tax compliance software market, with a TAM of $7B+, presents a highly attractive opportunity due to the challenges businesses face in complying with the complex tax regulations across various jurisdictions in the US and internationally. I believe Vertex, Inc. (NASDAQ:VERX) has strong growth prospects, driven by the acceleration of digital transformation projects amid the COVID-19 pandemic, leading to more cloud deployments. Additionally, there is a growing global market for new logo opportunities as businesses opt for custom-built ERP and outsourced tax service solutions. I expect that, as enterprises adopt other cloud platforms like ERP, Ecommerce, and procurement, the need for a packaged software solution like Vertex will become evident. The increasing complexity of tax compliance and the compelling return on investment for tax compliance software will eventually lead to widespread adoption, making automated solutions a necessity for all businesses. Hence, I view the stock as a long-term buy and expect the multiple to re-rate upwards over time.

Vertex Has Several Competitive Advantages

Vertex, Inc. holds a strong competitive position and is gaining a larger share in the US Tax Compliance software TAM market, which is valued at over $7 billion. The company boasts a significant customer base of 4,000+ clients, with more than half being Fortune 500 companies across various industries such as Retail, Wholesale Trade, Technology, Manufacturing, Financial Services, Communications & Transport, and Marketplaces. Vertex’s offerings cater to different deployment preferences, including on-premise, Cloud, or a Hybrid mix. This flexibility appeals to large enterprises that are transitioning parts of their infrastructure to the Cloud at different rates. The company’s Cloud options include both single-tenant and multi-tenant solutions, accommodating customers with data regulations or security concerns that require transactional data to remain behind the firewall. While on-premise deployments are currently more common, there is a growing trend of customers transitioning to Cloud deployments, often triggered by ERP replacements or the adoption of Cloud procurement and E-commerce platforms.

A significant advantage of Vertex is its extensive integration capabilities, with integrations with various accounting, CRM, ERP, payroll & HCM, point of sale, procurement, and subscription billing platforms. These integrations support high transaction volumes for multinational corporations and offer low latency between systems due to custom API capabilities. The company’s focus on native development rather than acquisitions has contributed to the strength of its platform and product suites. Vertex collaborates with its technology partners through joint certification programs and product road maps, enhancing its position and enabling access to sales personnel without compensating for introductions/leads.

Vertex’s content database covers 19,000 tax jurisdictions in 130 countries, comprising over 300 million unique rules, including industry-specific content. The company’s dedicated team of tax content professionals continually updates and expands the content library. Enterprise customers can also create custom rules for their business using Vertex’s user-friendly platform. Automation through AI/ML technologies is expected to further streamline tax updates, benefiting gross margins over time.

Company Presentation

Digital Transformation to Drive Growth

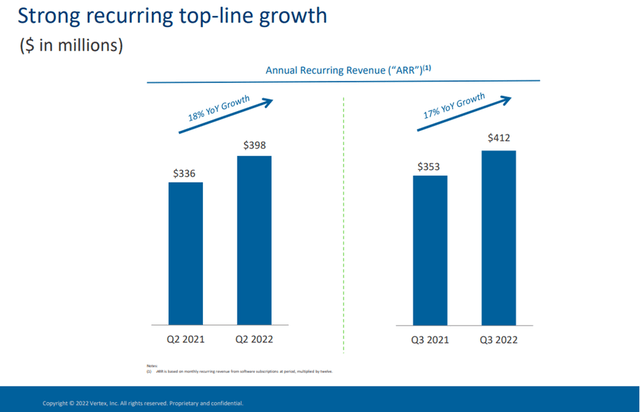

The growth in digital transformation projects post-COVID-19 has fueled a rapid shift from on-premise IT infrastructure to Cloud-based solutions. Vertex, Inc. is capitalizing on this trend, leveraging its substantial on-premise customer base as they transition parts or all of its tax compliance software to the Cloud. The company’s hybrid deployment options allow customers to optimize their IT infrastructure as it evolves. Many of Vertex’s clients operate across multiple channels, including E-commerce, in-store, and direct sales. The impact of COVID-19 has prompted these customers to reassess their volume requirements from different channels, leading to an increased preference for Cloud deployments and higher spending on Vertex’s services. I expect migrations to remain strong in FY22 and FY23 as many of these projects take time to develop and execute, particularly given the size of Vertex’s customer base. As a result, I expect Vertex will enjoy several years of mid-teens ARR growth.

Company Presentation

Valuation

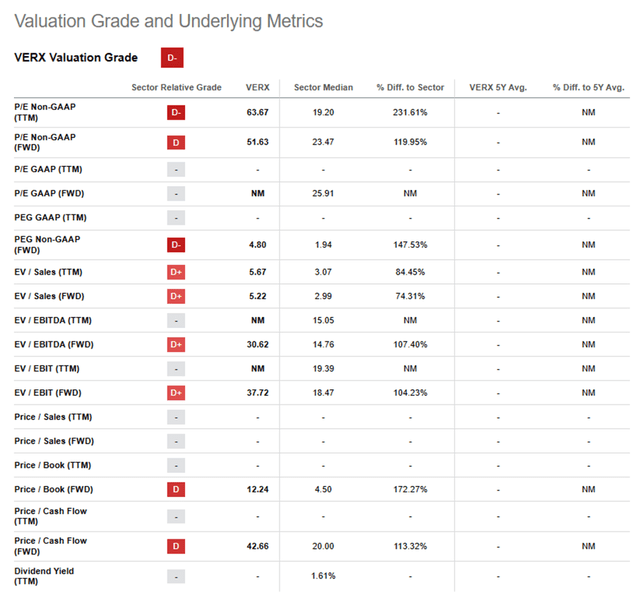

VERX is currently trading at 5.67x EV/Sales on the FY23 estimate. I expect the free cash flow margin to increase meaningfully in the near term as accelerated investments in the past few years yield results. I believe appropriate comparable valuations include Ceridian HCM Holding Inc. (CDAY) and Tyler Technologies, Inc. (TYL), both of whom are trading at a higher multiple compared to VERX. I believe the migration of the company’s on-premise customers to the Cloud will continue in the medium term, spurred by COVID-19, which sped up digital transformation projects and led enterprises of all sizes to re-evaluate their IT infrastructure. As a result, I believe Vertex can maintain mid-teens ARR growth over the medium term and generate steady double-digit subscription revenue growth and positive free cash flow. I believe the market for tax compliance software will expand as sales tax complexity evolves and states and municipalities increasingly depend on indirect tax revenue. Hence, I hold a positive view on the long-term prospects of the company. VERX is currently trading at 5.67x EV/Sales on the FY23 estimate. During the past 5 years, VERX has traded at a median EV to Sales multiple of 6.22x. VERX has increased investments in sales and marketing to target the mid-market and international markets over the past two years. However, recently management indicated that the investments have peaked. Hence, I expect the EBITDA and free cash flow margin to increase meaningfully and the multiple to continue to re-rate upwards.

Seeking Alpha

Risks

The indirect tax compliance software market is highly competitive versus both packaged software vendors and third-party consulting services. The company competes with a number of vendors outlined above in the report and relies on gaining new customers from accounting/consulting firms. Previously, on-premise deployments were favored for security reasons, but with improvements in cloud security, public cloud vendors like Avalara are now competing with traditional players such as Sovos and Thomson Reuters. Avalara has been making investments to cater to larger customers and expand its capabilities through product enhancements and acquisitions like Transaction Tax Resources. However, its limitation lies in offering only multi-tenant SaaS deployment. While Avalara is increasingly competitive up-market, it is important to note its solution is only offered as multi-tenant SaaS limiting deployment flexibility. Aside from the primary software competitors, Vertex also faces competition from outsourced tax services provided by Big 4 accounting firms and custom-built solutions from ERP vendors. Vertex sees potential growth opportunities in these areas due to its cost-effectiveness and strong return on investment. The key challenge for custom-built ERP solutions is the complexity of updating tax content through third-party involvement and internal management.

Conclusion

I have a positive view on VERX for several reasons. Firstly, the acceleration of digital transformation projects is prompting on-premise customers to shift towards Cloud deployments. This trend makes Tax Compliance software an attractive market for mid and large-sized customers as enterprises embrace Cloud technologies. Moreover, Vertex’s competitive position is well-positioned to capture market share in the US Tax Compliance software market, supported by its vast customer base of over 4,000 clients, flexibility to support on-premise, Cloud, or Hybrid deployments, extensive integrations, and continuous updates to its tax content database to accommodate rule changes.

Read the full article here