(This article was co-produced with Hoya Capital Real Estate.)

Having just returned from a month in London and Italy, the topic of international investing has been very much on my mind. As a result, I decided to get back into the swing of writing by taking a look at a favorite ETF of mine, Vanguard Total International Stock ETF (NASDAQ:VXUS).

Readers familiar with my work know that I have consistently written about the value, and importance, of including an allocation to international equities in one’s portfolio. And yet, it must be admitted that, for quite a lengthy stretch of time, doing so has resulted in underperformance compared to devoting one’s entire stock allocation to the U.S. market.

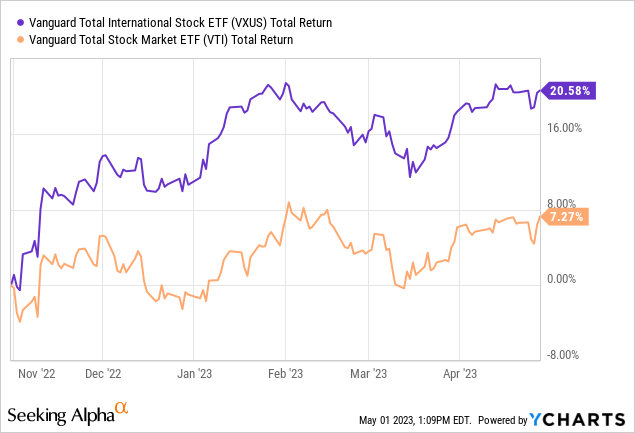

However, take a quick look at the graphic below. It is a simple total-return comparison of our subject ETF and its U.S. counterpart, Vanguard Total Stock Market ETF (VTI), over the past 6 months.

Certainly, investors holding VXUS, or similar ETFs such as Vanguard FTSE All-World ex-US ETF (VEU) or iShares Core MSCI Total International Stock ETF (IXUS), have been very happy they did so over this period of time. While I don’t currently hold VXUS in my personal portfolio, I do hold both VEU and IXUS, and they have made a nice contribution to my recent returns.

Analysis and Outlook

Here, though, is the question. Can we identify what led to the recent underperformance of U.S. stocks as opposed to international stocks? More importantly, what is the outlook going forward?

The brief discussion that follows will be based on concepts from recent research reports from Vanguard and Bridgewater Associates. Due to restrictions on sharing any graphics from the Bridgewater report, I will share a graphic from JPMorgan that will serve to make the same basic point.

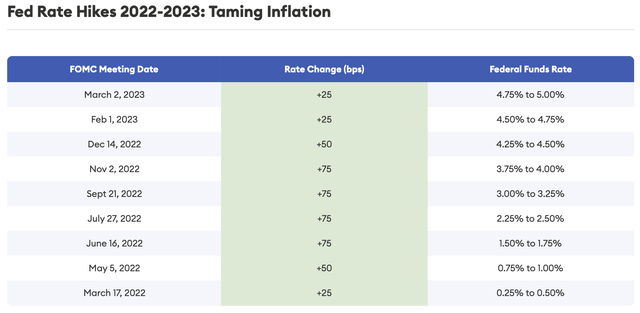

First of all, let’s talk about monetary policy in general. Likely, anyone reading this article is thoroughly familiar with what the Federal Reserve has done in recent months.

Given where we sit now, it may be easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022. On top of that, it was still purchasing billions of dollars of bonds every month to stimulate the economy.

However, as outlined in the graphic below, since that time the Fed has raised the Fed funds rate by nearly five percentage points. As this article is written, the fed funds rate sits in a range of 4.75% – 5.00%, and most observers appear to be expecting yet one more .25% increase at the next meeting.

Fed Rate Hikes 2022-2023 (Forbes)

Even though conditions have been relatively similar in other developed parts of the world, policymakers in Europe and other areas have not raised rates as forcefully as their U.S. counterparts.

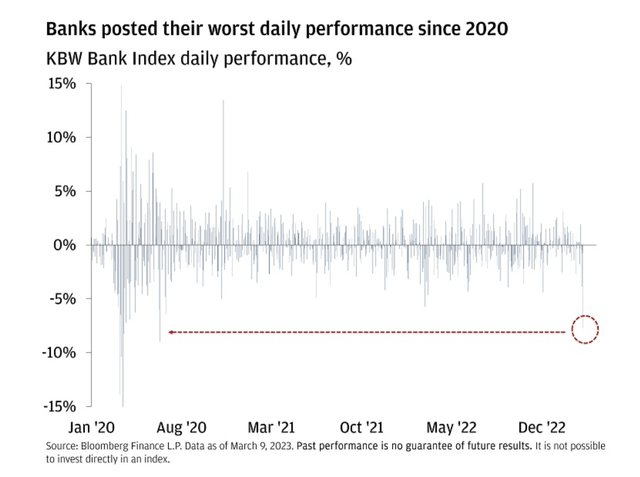

Next, let’s briefly talk about just one side effect from all of this. As I write this article, just this morning, news broke that federal regulators took possession of First Republic Bank and sold its deposits and assets to JPMorgan. The seizure of First Republic resulted in the biggest bank failure since the 2008 financial crisis, when Washington Mutual imploded.

Even before this event, triggered by the previous defaults of Silicon Valley Bank and Signature Bank, U.S. bank stocks posted their worst daily performance since 2020, as depicted in the below graphic from JPMorgan using data as of March 9, 2023.

Bank Stocks Performance (J.P. Morgan Wealth Management)

The Bridgewater report I reviewed had a nice graphic demonstrating that there was a marked difference between the market response in the U.S. as compared to foreign markets based on how exposed they were to the U.S. banking crisis, as well as the degree to which policymakers had previously tightened liquidity. In other words, bank equity indexes in Europe experienced a much smaller decline than their U.S. counterparts, and in Asia, they barely fell at all.

These items, combined with related factors, appear to comprise a large reason for the recent outperformance of international equities.

With that brief overview, let’s now turn briefly to the forward-looking outlook. Does this recent period of outperformance mean you should consider selling an ETF such as VXUS and investing the funds back into the U.S.?

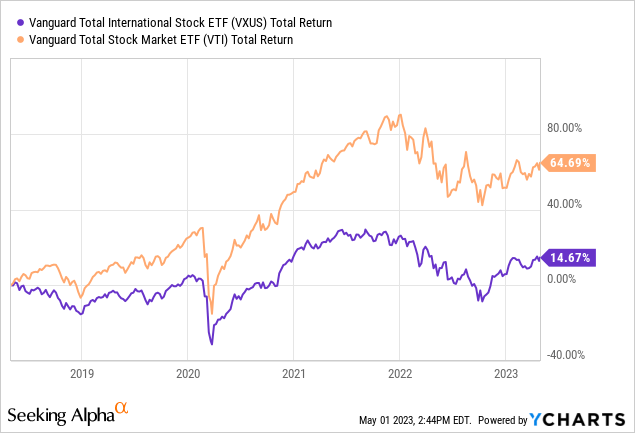

Not so fast. To maintain the simplest of perspectives, let’s take that 6-month VXUS vs. VTI graphic that we started with and expand it out to 5 years. Have a look.

It’s an interesting graphic to consider. It can quickly be discerned that the two years or so following the COVID-19 pandemic were a period of extreme outperformance for U.S. stocks. Makes sense, doesn’t it? Just think back not only to U.S. interest rates being pegged at basically zero, but the tremendous amount of fiscal stimulus that was pumped into the U.S. economy.

Since the beginning of 2022, it can be seen that U.S. and international stocks have behaved more similarly. And, as featured in our opening graphic, the last 6 months specifically have been exceptionally good for international stocks.

Still, there are some factors at work that provide a nice tailwind, and the potential for outperformance, when it comes to international stocks.

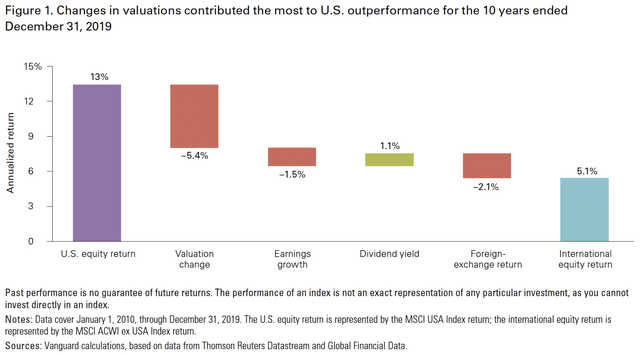

Here is just one graphic I used in a previous article on VXUS to feature this.

Components of U.S. vs. Foreign Stock Performance Differences (Vanguard Research)

This graphic, from Vanguard research, reconciled the roughly 13% annual return generated by U.S. stocks over the 10 years ending December 31, 2019 to the roughly 5.1% return generated by international equities. For purposes of this discussion, please focus on the largest single component; valuation change. Simply put, this means that a large part of that difference was simply that U.S. stocks became more expensive in relative terms. Additionally, during the decade in question, it can be seen that a strong U.S. dollar contributed to a 2.1% loss in returns to international assets held by a U.S. investor.

Now, this data is somewhat outdated. However, please remember that I just featured that the outperformance of U.S. stocks actually accelerated through the end of 2022. So, conceptually, the basic principles still stand.

Put a different way, the outperformance of international stocks over the past 6 months doesn’t mean there is not yet further room for these to run, so to speak.

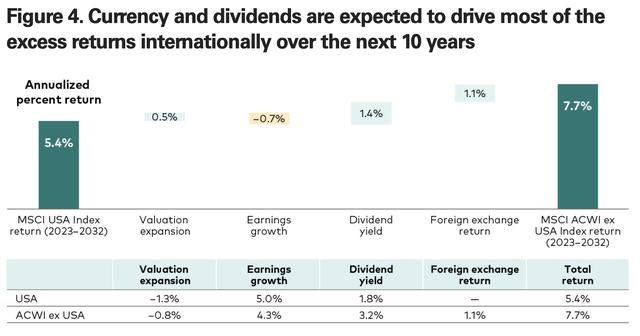

I’ll close this section with one last forward-looking graphic from Vanguard. Essentially, this graphic is the inverse of the previous one I shared.

Expected 10-Year International vs. U.S. Returns (Vanguard Research)

As can be seen, Vanguard is forecasting average annual returns of 7.7% for international stocks over the next 10 years, as opposed to 5.4% from U.S. stocks. The biggest components, in their estimation? Valuation expansion, superior dividend yield, and a weaker U.S. dollar leading to positive foreign exchange returns.

Vanguard Total International Stock ETF – A Proven Winner

With all of that said, we come full circle back to VXUS, the featured ETF of this article.

In a nutshell, if you find yourself in agreement with this analysis and are desirous of including some allocation to foreign stocks in your portfolio, in my opinion, you really can’t do better than VXUS.

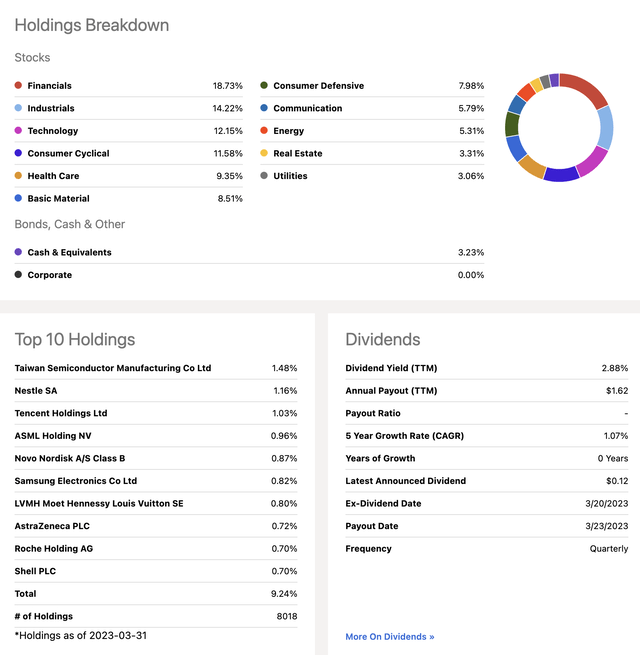

This beautiful combination graphic from right here on Seeking Alpha captures it nicely.

VXUS: Portfolio Characteristics (Seeking Alpha)

VXUS offers you exposure to almost 8,000 stocks outside the U.S., across the entire spectrum of size; small-, medium-, and large-caps. And it does all of this at a rock-bottom expense ratio of .07%.

Its impressive diversification can be seen in its Top 10 holdings, which comprise a mere 9.24% of the fund. The latest data on the Vanguard website, as of 3/31/23, show an overall P/E ratio of 12.5 and P/B ratio of 1.6 for VXUS, as opposed to 19.7 and 3.5, respectively for VTI, its U.S. counterpart. Finally, investors interested in income as a component of total return may wish to take note of that 2.88% dividend yield.

Just one last comment. Careful readers may have caught my previous admission that I don’t hold VXUS in my portfolio, holding VEU and IXUS instead. Long story short, this is simply due to my historical personal circumstances. Some years back, in my taxable account, I made the decision to purchase VEU as opposed to VXUS. Since this is a long-term holding, I have some reasonably sizable capital gains that would trigger if I were to sell VEU simply to switch to VXUS. If recall serves, the reason I selected IXUS in my retirement account as opposed to VXUS some years back is that Fidelity offered commission-free trading at the time in ETFs from the iShares family, but not Vanguard.

In other words, please don’t take any of that to be in any way a negative connotation when it comes to VXUS. Just the quirks of my personal situation, that’s all.

I hope you have found this article interesting. Please, feel free to share your comments, questions, and yes even criticisms in the comments section below.

Read the full article here