Investment Thesis

W.W. Grainger, Inc. (NYSE:GWW) specializes in the skilled distribution of industrial supplies and machinery. Over the last five years, the company’s shares have been on an upward trajectory, gaining more than 126%. In fact, the shares are trailing at 51.06%. I attribute this solid growth to the company’s solid financial performance in the said period.

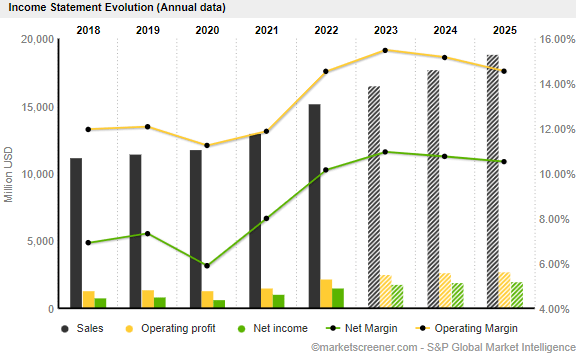

Market Screener

The company’s successful expansion plans, particularly its investment in e-commerce and its good business model anchored in key partnerships, are, in my opinion, responsible for this great financial performance. According to the economic forecast shown in the graph above, the company’s financial outlook is estimated to improve further, indicating future prosperity. However, looking at the current valuation, it appears that the market has already valued the anticipated growth in the current valuation, which is a good point for investors to cash out the gains.

Investment In E-commerce And Strong Customer Relationship: Long-term Growth Drivers

Grainger’s expansion activities have helped the company maintain a leading position in the US maintenance, repair, and operation [MRO] sector. By developing superior MRO solutions, providing unmatched customer service, and providing differentiated sales and services, the company hopes to outperform the competition by 300-400 basis points. To increase the sales team’s effectiveness, it will continue to work to improve connections with major and mid-sized clients.

Grainger is concentrating on enhancing the customer experience by investing in its digital and e-commerce capabilities and implementing supply chain improvement projects. Their full-service and web-only businesses increased the industrial products distributor’s total 2022 sales by 16.9% year over year to $15.2 billion, which in my opinion, demonstrates how vital its e-commerce is. Most interestingly, e-commerce is projected to grow very strongly by 2028, which leaves me optimistic about the company’s topline considering how strong the market is projected to grow. The global e-commerce market is expected to grow by 26.55% CAGR between 2022 and 2028, from $14.30 trillion in 2021 to $58.74 trillion in 2028.

A lot Of Positives

Both the High Touch Solutions segment’s volume increase and the Endless Assortment segment’s customer growth have benefited GWW. Given the soaring cost and supply constraints, this is remarkable—Grainger’s efforts to efficiently manage inventories and invest in marketing also fuel profitability. In addition to this positive aspect, the company also has other enticing features that attract investors. Below are some of them;

- Solid Q1 Results: In the first quarter of 2023, Grainger recorded profits per share of $9.61. The bottom line increased 36% from the previous year thanks to solid operating results and better margins in the High-Touch Solutions North America [NA] and Endless Assortment divisions.

- Upbeat Outlook: Grainger estimates net sales for the current year to range between $16.2 billion and $16.8 billion, supported by solid first-quarter performance. From the previously announced $32-$34.50, the company increased its earnings per share projection to $34.25-$36.75. The midpoint of the revised projection shows a 20% increase from the reported amount for 2022.

- Strong Topline Growth & Segment Performance: The corporation announced excellent earnings in both segments during the first quarter of 2023. The High-Touch Solutions North America NA division benefited from good price realization and ongoing volume growth across all geographies. An enhanced product mix and a favorable price spread, which realized a timing benefit, drove the gross margin. This segment’s daily sales increased 14.5% from last year’s quarter. The price actions and strength in the commercial, transportation, and heavy manufacturing sectors will continue to help the category.

Daily sales for the Endless Assortment category increased by 3.8% in the first quarter compared to last year’s period. Zoro US’s core small business growth with new and returning customers helped this segment’s net sales. Revenues for this category at MonotaRO also increased due to client growth, repeat business, and enterprise customers.

These are some of the key aspects of the overall favorable perception of this company. These considerations for making financial decisions, in my opinion, are highly convincing.

The Financial Front

Growth investors concentrate on companies that are experiencing financial growth that is above average since this characteristic enables these assets to attract the market’s attention and offer stable returns. Given this background, below are its major growth aspects financially.

Growth in Earnings

Perhaps nothing is more significant than earnings growth, given that the majority of investors seek out soaring profit levels. Growth investors highly prefer double-digit profit growth since it is frequently interpreted as a sign of promising futures (and stock price increases) for the firm under consideration.

Investors should pay attention to the predicted growth rather than the actual growth, even though W.W. Grainger’s historical EPS growth rate is 14%. This year, the company’s EPS is expected to increase by 19.8%, above the industry average of 13.6%.

Growth in Cash Flow

Although cash is the lifeblood of any organization, growth in higher-than-average cash flow is more crucial and advantageous for growth-oriented businesses than for mature companies. This is due to the fact that increased cash flow enables these enterprises to grow their operations without requiring costly outside financing.

GWW is now growing its cash flow year over year by 43.4%. In fact, higher than the 24.4% industry average. Investors should focus on the current cash flow growth, but evaluating the historical rate is important to put the present reading into context. In comparison to the industry average of 8%, the company’s annualized cash flow growth rate during the last three to five years was 13.4%.

Valuation

Going by relative valuation metrics, GWW appears to be trading at a premium, given its F grading on valuation by seeking alpha. With PE, PS, and PB ratios of 22.16, 2.34, and 13.25, respectively, being higher than the industry medians of 19.33, 1.35, and 2.66, respectively, it’s very apparent that this company is trading at a premium. Although this company has a lot of growth prospects, as exhibited by its high future financial estimates, I tend to believe that the market has already priced in this expected growth at the current price. Therefore it has a minimum upside potential in its share price.

Further, a DCF model by Finbox proves that this company trades at a premium and has a more substantial downward potential than an upside. Below is the output of the model and its assumption.

Finbox

Given this background, I believe the opportunity in this company is to cash out profits and wait for a cheaper entry point to leverage its promising future.

Conclusion

In conclusion, GWW is a good company with solid fundamentals and growth potential. However, its current valuation has a strong downside potential than the upside, and the company is trading at a premium. As a result, I rate this company a sell and wait for a cheaper entry point.

Read the full article here