Westinghouse Air Brake Technologies Corporation (NYSE:WAB) recently delivered impressive double digit quarterly net income growth and net sales growth. It also announced modernization of the fleet and the acquisition of new assets. Also, with new information about the new Integration 2.0 plan, WAB appears to be a stock that market participants may want to read about. Yes, there are risks from the supply chain disruptions, lack of innovation, or cybersecurity attacks, however the company could trade at higher marks. Future FCF would imply a higher stock valuation.

Westinghouse Air Brake

Westinghouse Air Brake Companion, operating under Wabtec Corporation, primarily serves the global passenger transit and freight rail industries.

The company depends directly on the activity and investments that public or private agencies make in the freight train lines or in the adaptation, improvement, and expansion in terms of passenger transit. These two focuses of Wabtec’s work are the ones that give their name to their business segments: freight trains and passenger transit.

The freight train segment is dedicated, among other things, to the manufacture of new locomotives, the distribution of spare parts for existing locomotives, control of track safety conditions, technological products for infrastructure management, engineering services, and signage and software solutions to optimize the performance of its customers.

Wabtec is the international manufacturer of hybrid diesel-electric locomotives. At this moment, it is estimated that around 23k of its locomotives are circulating on the freight tracks. A large part of the sales in this segment occurs in the after-sales market for maintenance, adaptation, and repair of existing tracks or locomotives.

On the other hand, the passenger transit segment is mainly oriented to the manufacture of parts for old or new vehicles, including regional trains, high-speed trains, subway cars, track control supplements, and electronic services in this regard.

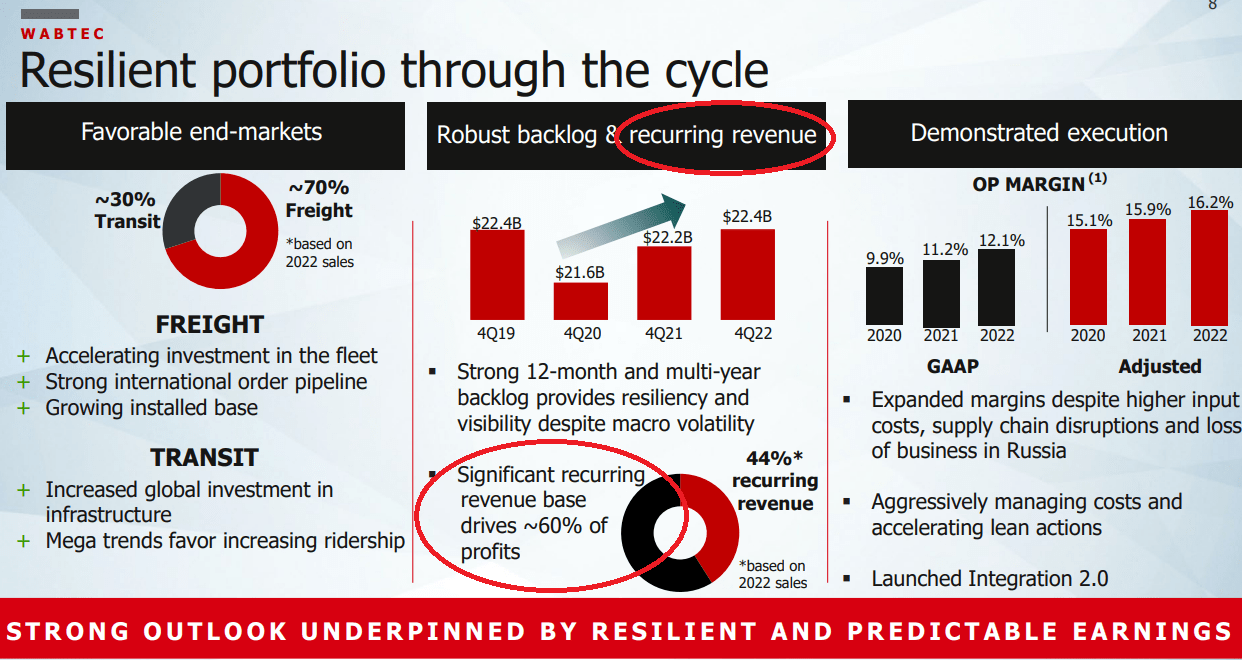

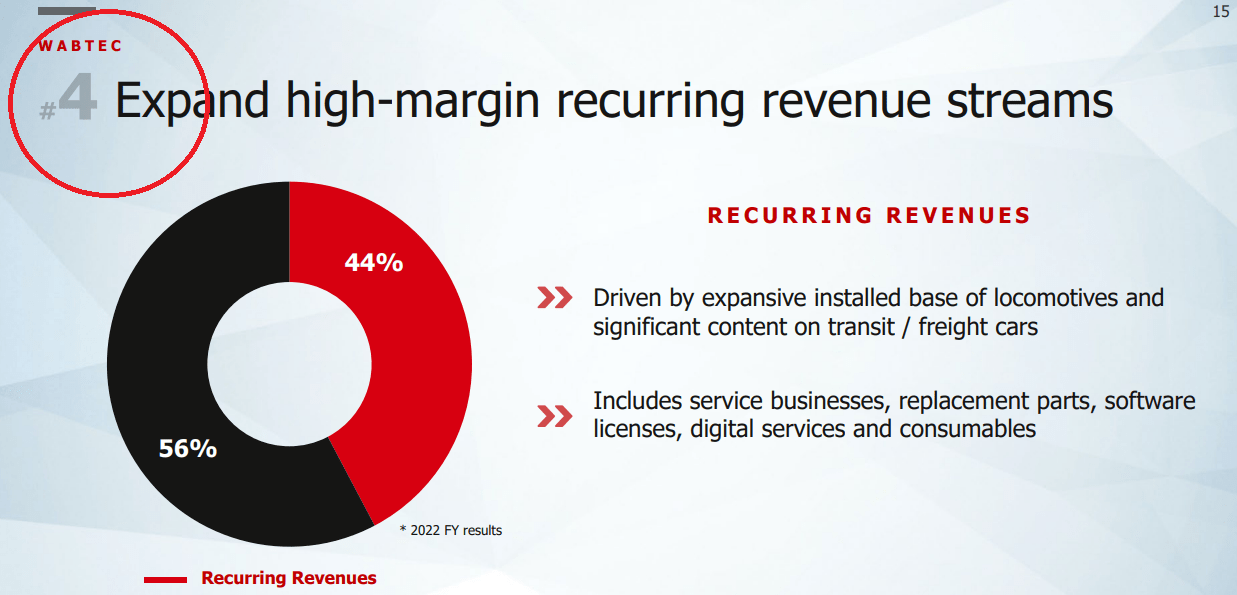

I believe that the most interesting thing about Westinghouse Air Brake is the recent growth in the operating margins and the recurring revenue. GAAP operating margin increased from close to 9.9% in 2020 to about 12.1% in 2022. Besides, the total amount of recurring revenue is another beneficial aspect that most investors would welcome.

Source: Investor Presentation

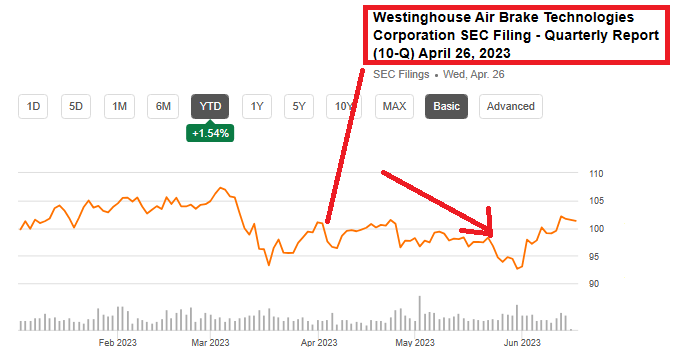

Quarterly Report: Less Shares Outstanding And Beneficial Net Income Growth, But The Market Did Not React To The New Figures

I believe that the figures reported in the last quarter were quite beneficial. They included double digit net income growth as well as double digit net sales growth. Even if market participants are not reacting well to the new figures, I believe that the company is going in the right direction.

Source: SA

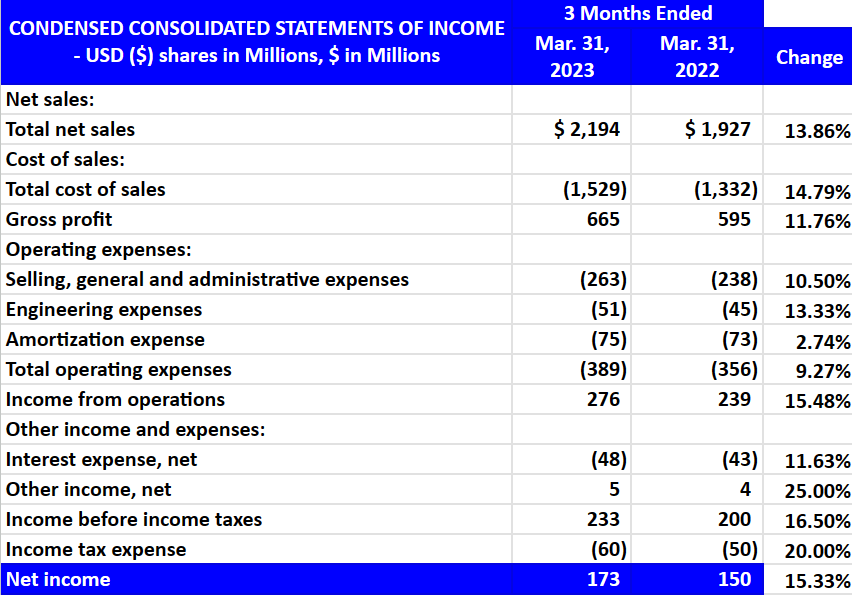

In the quarter ended March 31, 2023, the company reported total net sales of $2.194 billion, 13% more than that in the same period in 2022. The gross profit stood at $665 million, showing 11% increase y/y. Besides, the company reported selling, general, and administrative expenses of -$263 million, with engineering expenses of -$51 million, amortization expense of -$75 million, and net income close to $173 million. The net income increased by 15% as compared to the figures in 2022.

Source: 10-Q

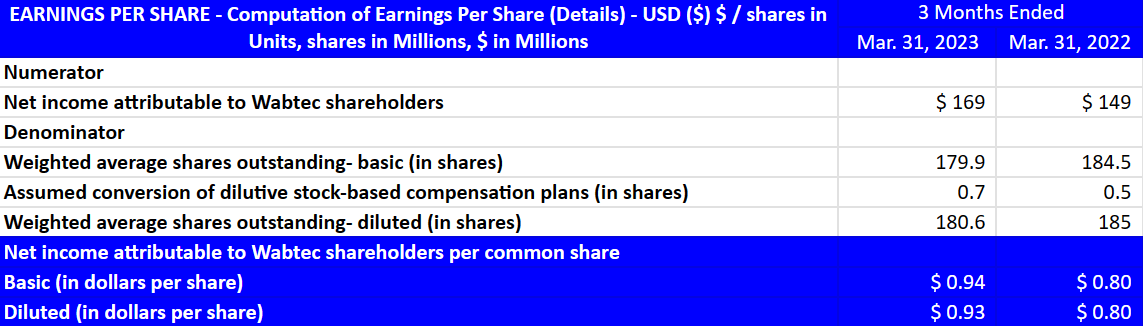

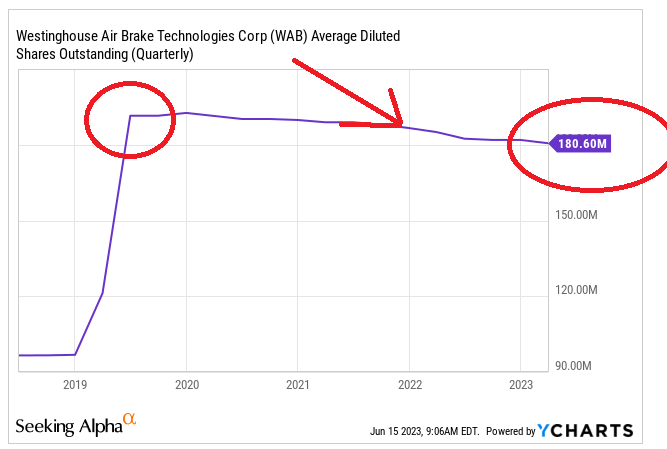

Taking into account a weighted average shares outstanding of 180.6 million shares, the EPS stood at $0.94 per share. I do appreciate quite a bit that the share count appears to be declining. Further decrease may lead to an increase in the implied stock valuation.

Source: 10-Q Source: Ycharts

Balance Sheet

In the last quarter, management reported a small increase in the total amount of assets driven by increase in inventories. The total amount of cash decreased to finance the new inventories. The management also reported a significant reduction in the total amount of debt.

In my view, investors will do good by noting the large amount of goodwill noted by Westinghouse Air Brake, which was registered after acquisitions made in the past. In this regard, it is worth noting that goodwill impairments could occur. Besides, I believe that future M&A transactions could be expected. Westinghouse Air Brake appears to know how to buy and integrate targets, and appears to report a lot of inorganic growth.

During the twelve months ended December 31, 2022, the Freight Segment made three strategic acquisitions for a combined purchase price of $89 million. Two of the acquisitions are reported in the Digital Intelligence product line and one is reported in the Services product line. Each of the acquisitions in 2022 are individually and collectively immaterial. Source: 10-Q

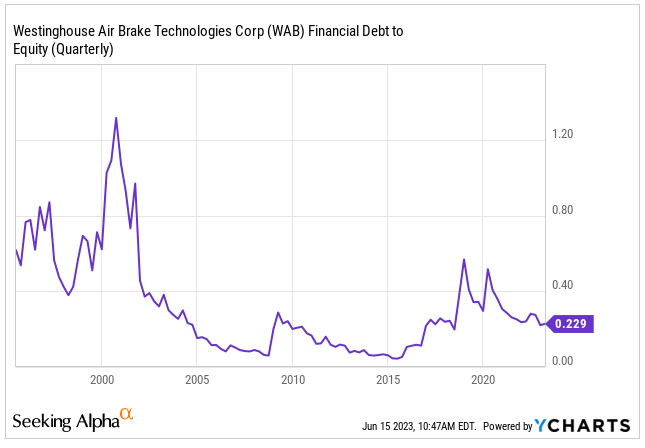

Certain investors may also not appreciate the total amount of debt, however I would not really be worried. In the past, Westinghouse reported a larger financial debt/equity ratio. I really do not think that the total debt would put pressure on the EV/EBITDA or EV/FCF multiple.

Source: Ycharts

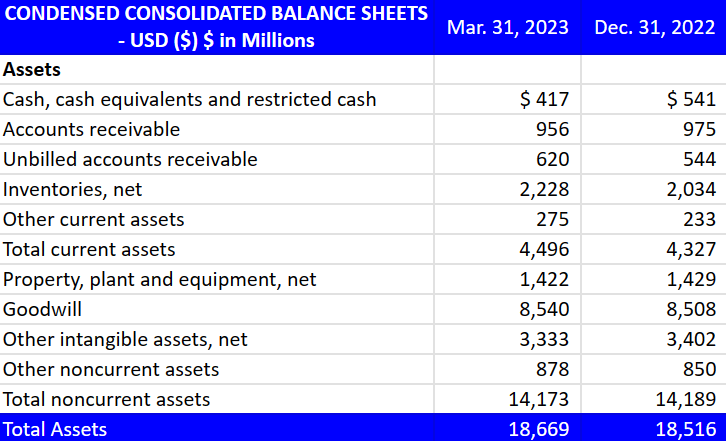

As of March 31, 2023, the company reported cash, cash equivalents, and restricted cash worth $417 million, accounts receivable close to $956 million, unbilled accounts receivable of $620 million, and inventories close to $2.228 billion. Total current assets were equal to $4.496 billion, larger than the total amount of current liabilities. I am not really concerned about a liquidity issue here.

Long term liabilities included property, plant and equipment close to $1.422 billion, goodwill of $8.54 billion, and total assets of $18.669 billion. The asset/liability ratio stands at more than 2x. Hence, I believe that the financial situation appears in good shape.

Source: 10-Q

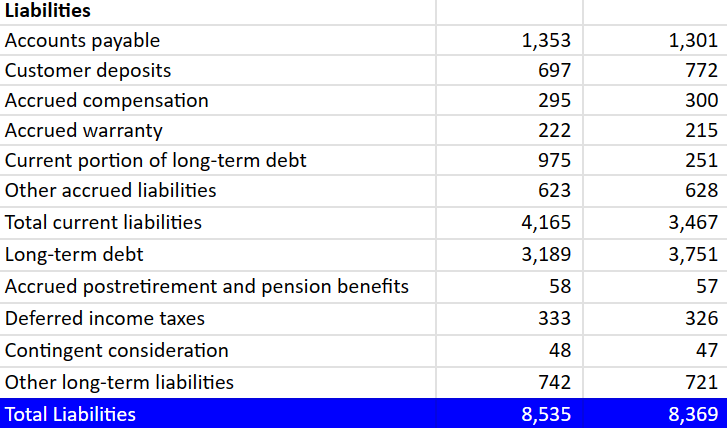

With regard to the list of liabilities, Westinghouse included accounts payable of $1.353 billion, customer deposits worth $697 million, and current portion of long-term debt close to $975 million.

Also, with long-term debt of $3.189 billion, accrued postretirement and pension benefits worth $58 million, and contingent consideration of about $48 million, total liabilities were equal to $8.535 billion.

Source: 10-Q

My DCF Model Implied A Valuation Of $137 Per Share

Among the drivers of FCF growth, I believe that acceleration of innovation and scale of technologies could bring a lot of surprises in the coming years. In my view, in the future, innovations with respect to new equipment and digital intelligence could help compensate for the negative effects on FCF of supply chain disruptions, labor availability, and inflation that we saw in the most recent quarterly report.

Supply chain disruptions and labor availability have caused component, raw material and chip shortages resulting in an adverse effect on the timing of the Company’s revenue and cash flows. Additionally, broad-based inflation, metals, energy and other commodity costs, transportation and logistics costs, labor costs, and foreign currency exchange rate fluctuations all continue to impact our results. Source: 10-Q

I would also expect that the Integration 2.0 plan announced recently would be beneficial for the company. I believe that the company will be making a lot of efforts in the coming quarters, so I hope that the stock price trends higher again.

During the first quarter of 2022, Wabtec announced Integration 2.0, a three-year strategic initiative to target incremental run rate synergies estimated to be between $75 million and $90 million by 2025. The Company anticipates that it will incur one-time restructuring charges of approximately $135 million to $165 million related to this initiative, of which approximately $78 million has been incurred through March 31, 2023. Total estimated initiative charges could change based on the specific programs approved or changes to the scope of the review. Source: 10-Q

I believe that further expansion of higher-margin recurring revenue streams as promised in the last presentation to investors would have an impact on FCF generation. Recurrent revenue is quite relevant for financial modelers and investment bankers because they are a bit more sure about the company obtaining future net sales.

Source: Investor Presentation

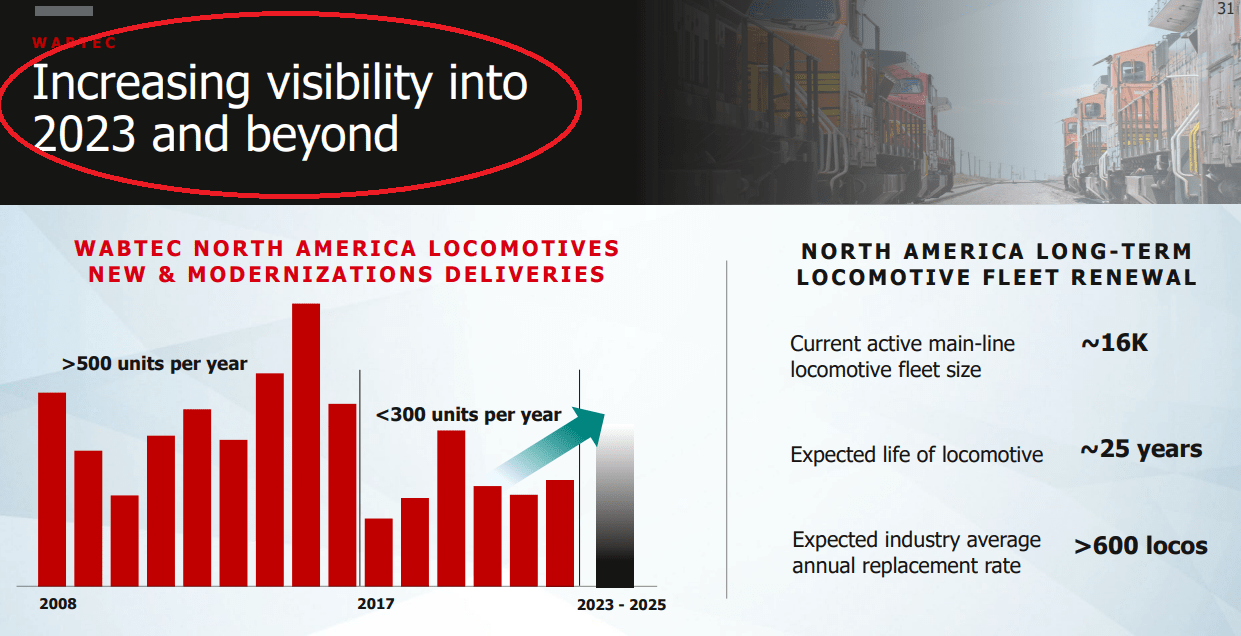

Finally, I believe that modernization of the fleet and acquisition of new assets could encourage financial analysts to enhance their expectations about the future of Westinghouse Air Brake. The company promised some of these initiatives in a presentation to investors.

Source: Investor Presentation

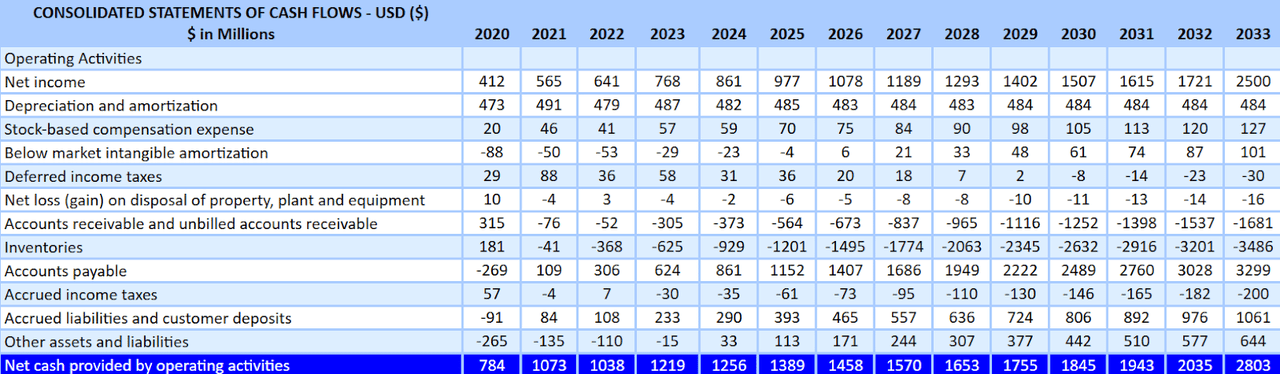

My financial model includes 2033 net income close to $2.5 billion, 2033 depreciation and amortization close to $483.5 million, stock-based compensation expense of $127.5 million, and below market intangible amortization of $101.5 million. Also, with changes in plant and equipment worth -$16 million and changes in accounts receivable and unbilled accounts receivable of about -$1.68255 billion, changes in inventories would be close to -$3.48755 billion.

Finally, with changes in accounts payable worth $3.298 billion, 2033 net cash provided by operating activities would be $2.802 billion. If we also include 2033 purchases of property, plant and equipment worth -$244.55 million, 2033 FCF would be $2.558 billion.

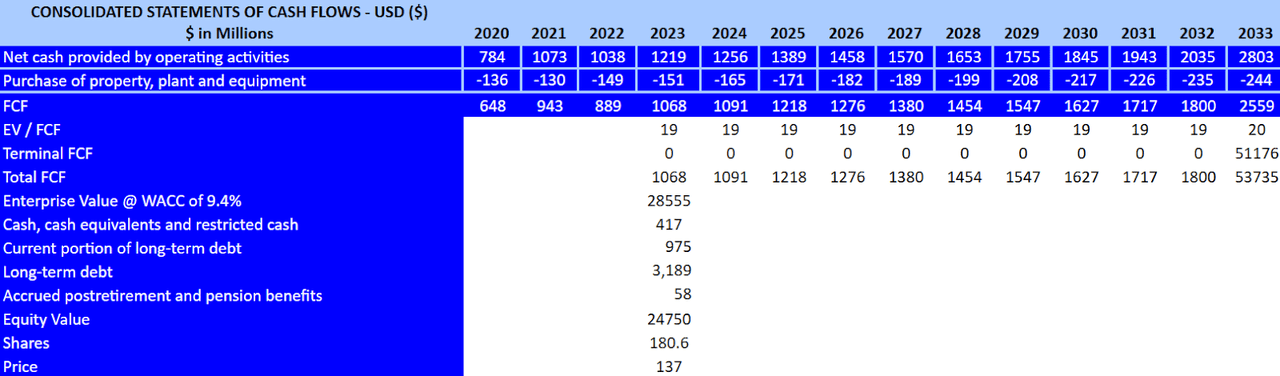

Source: My DCF Model

If we assume 2033 EV/FCF 20.55x the enterprise value with a WACC of 9.455% would stand at $28.55 billion. Now, if we add cash, cash equivalents and restricted cash worth $417 million, and subtract current portion of long-term debt close to $975 million, long-term debt of $3.189 billion, and accrued postretirement and pension benefits worth $58 million, the equity value would be $24.755 billion, and the implied price would be $137 per share. Considering the current stock price, I do see an upside potential in Westinghouse Air Brake.

Source: My DCF Model

Large Competitors, But Westinghouse Air Brake Has Substantial Expertise And Quality Products

The competition for this company varies according to the product line and the geography. In the original parts market in the United States, the main competitors are New York Air Brake Company and Amsted Rail Company, Inc. When it comes to diesel-electric locomotives, the main competitor is Electro-Motive Diesel, a division of Caterpillar (CAT).

Internationally, although not in all product lines, the biggest competitor is Knorr (OTCPK:KNRRY), mainly in products that refer to the passenger transit segment. Other competitors include corporations such as CRRC Corporation Limited (OTCPK:CRCCY), a manufacturer located in China, small producers of specific parts, and local suppliers in almost all markets. In my view, Wabtec has experience in the market, and the quality of its products, the relationship with historical clients, and the capacity for innovation in technology are its great values at the corporate level to remain competitive in all production lines.

Risks

Among the risks that we can highlight for Wabtec, in the first place and at an operational level, we must mention the lack of diversification in its clients. Some of them mean a large portion of net sales. If one of the most relevant clients leaves Wabtec, the decline in net sales could lead to a significant drop in the stock price.

In 2022, the Transit Segment accounted for approximately 28% of our total net sales, with approximately 17% of its net sales in the U.S. Approximately half of the Transit Segment’s net sales are in the aftermarket with the remainder in the original equipment market. Source: 10-k

In the same sense, inability to read the new trends in the market and lack of adaptation to the technological innovations in progress in the market could affect the operations of the company. As a result, the company may have to lower its prices, which may push the FCF margins down.

It is also worth noting that Westinghouse Air Brake may suffer cyber security incidents, which may compromise the reputation of the brand or the data of clients. In this regard, investors may need to read about the cyber security incident that occurred on June 26, 2022:

As previously announced, on June 26, 2022, we detected a cyber security incident which impacted the Company’s network. The Company promptly activated incident response protocols, which included shutting down certain systems, and commenced an investigation of the incident. The Company also notified law enforcement and engaged legal counsel and other third-party incident response and cybersecurity professionals. Source: 10-Q

In a broader sense, different aspects of the nature of the business, among which we can name complications in the supply chain, transport prices, uncertainty in some regional markets, and the current war in Europe, are risk factors to take into account when analyzing Wabtec.

Conclusion

Westinghouse Air Brake did not only report a significant amount of recurrent revenue, the company also announced plans about the modernization of the fleet and the acquisition of new assets. I also hope that the Integration 2.0 plan recently announced by management enhances the future FCF margins. In any case, I believe that there are a number of reasons to believe that the implied price could be higher than the current price mark. Yes, there are risks from supply chain disruptions, cybersecurity issues, and lack of innovation, however future FCF justifies a fair price close to $137 per share.

Read the full article here