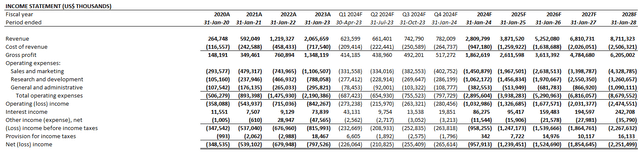

Snowflake Inc. (NYSE:SNOW) stock had its steepest intra-day decline in extended trading May 24 after upbeat fiscal first quarter results were overshadowed by a weak guidance that included another downward adjustment to full year product sales expectations. The development continues to highlight the intensifying challenges to Snowflake’s consumption-based business model as recessionary headwinds pick up. Signs of deceleration earlier in the year, observed at key hyperscaler partners, such as at Microsoft Corporation (MSFT) Azure and Amazon.com, Inc.’s (AMZN) AWS, are starting to impact the software company’s demand environment.

In addition to challenges ensuing from the uncertain macroeconomic environment, the structural shift in end-market preference for “cloud optimization” is also becoming an increasingly prominent challenge to Snowflake’s growth trajectory. Rising enterprise demand for cloud optimization is expected to weigh on Snowflake’s monetization efforts, and further exacerbate the current impact of a cautious IT spending environment due to transient macroeconomic headwinds. Taken together, we remain incrementally cautious over the durability of the stock’s substantial valuation premium relative to peers and to Snowflake’s fundamental prospects, especially amid the volatile market climate.

Macroeconomic and Optimization Headwinds

As discussed in our previous coverage on the stock, the consumption-based business model is typically first to experience a pullback during a recessionary environment, given the flexibility provided for customers to scale usage on an as-needed basis. With hyperscaler and key deployment partner AWS continuing to warn of deceleration in its latest earnings release, it was inevitable for the related impacts to be flowing through to Snowflake as well. This is consistent with management’s acknowledgement that AWS’ deceleration in recent quarters due to both transient macroeconomic uncertainties, as well as a more structural shift in enterprise demand for cloud optimization, have also been felt at Snowflake during the fiscal first quarter.

Well, we think that because Amazon is such a large percentage of our overall deployments, that they are good proxy. We just know from talking to them that what they experienced, we experienced as well. So, there’s definitely a ripple effect because we’re in the stack.

Source: Snowflake F1Q24 Earnings Call Transcript.

Admittedly, the consumption-based business model creates an unpredictable growth roadmap for the company given uncertainties over the timeline of fulfilling contracted performance obligations, resulting in a bumpy revenue trajectory. While risks of a slower pace in which contracted revenues, or remaining performance obligations, can be realized into P&L at Snowflake due to macroeconomic headwinds are likely transient, there is also growing wariness of an industry-wide shift in preference for cloud optimization, which is shaping up as a more structural challenge ahead. The increasing implementation of cloud spend optimization among the enterprise end-market – or demands to “do more with less” – is likely to dampen Snowflake’s growth prospects and slow its ongoing margin expansion efforts.

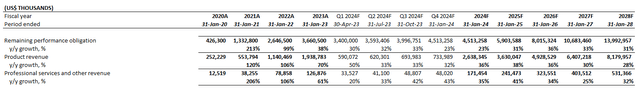

The challenge ensuing from rising cloud optimization demands is further corroborated by the stark y/y deceleration and q/q decline in Snowflake’s RPO growth during the fiscal first quarter due to hesitation among large customers to “sign large multi-year deals,” as well as tightened “data retention policies” that have subsequently reduced data storage and compute demand. This is consistent with deployment partner AWS’ recent observations that end-market cloud optimization demand is not a temporary “cost-cutting effort” in response to macroeconomic uncertainties, but rather a structural shift in the industry’s cloud migration strategy:

Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions…Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so…I think it’s important to remember that customers are pretty explicitly telling us that this is not a cost cutting effort where we intend on spending less money on technology or on the cloud. This is our reprioritizing what matters most to our business at this time and trying to reallocate resource so we can build new customer experience [and change what’s possible].

Source: Amazon 4Q22 and 1Q23 Earnings Call Transcripts

Snowflake management has also cited similar observations of increased scrutiny over the company’s pricing model by several large customers since April, highlighting the impact of cost opaqueness in consumption-based business model, which we had discussed in the previous coverage as an operating challenge.

…the nascent implementation of the consumption-based revenue model across software deployment has led to customer frustration over the lack of transparency in pricing…The majority of Snowflake’s software solutions provided are also hosted on non-user-managed servers (except serverless services compute), which potentially subjects customers to higher-than-expected “peak capacity” rates as well, [and] likely a more prominent impact for users charged based on an on-demand rate.

Source: “Do You Really Understand Snowflake’s Revenue Model?”

Then ensuing demand challenge is also consistent with management’s decision to cut fiscal 2024 product sales guidance from the previous $2.7 billion (+39% y/y) to $2.6 billion (+34% y/y). This would imply full year RPO growth in the 20% range based on a revenue recognition rate of 58%, in line with historical trends as well as management’s expectations for 57% conversion of the current $3.4 billion RPO balance to revenue over the next 12 months. RPO growth in the 20% range for fiscal 2024 would be half the pace observed in fiscal 2023 and suggests risks to the durability of market’s long-term growth expectations for Snowflake priced into the stock at current levels.

Author Author

Valuation Analysis

Author

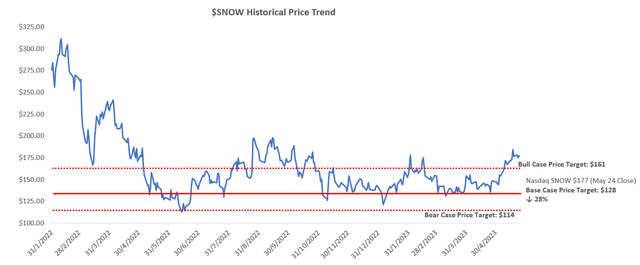

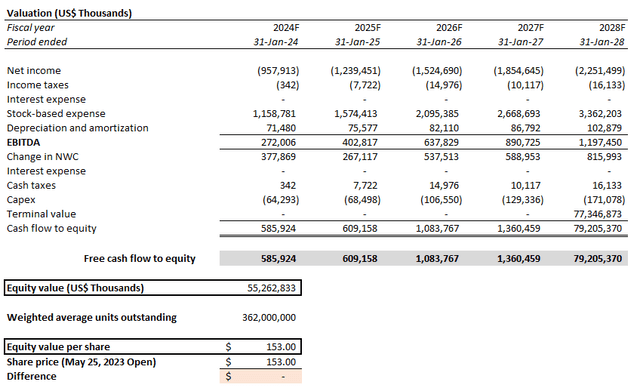

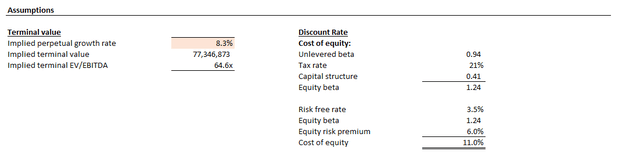

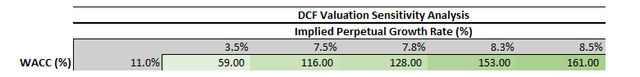

The Snowflake stock’s current per share price in the $150-range implies a perpetual growth rate of more than 8% based on the discounted cash flow valuation analysis. The discounted cash flow (“DCF”) analysis takes projected cash flows in conjunction with our fundamental forecast analysis on Snowflake, adjusted for actual fiscal first quarter results and management’s fiscal 2024 guidance, and applies a WACC of 11% in line with the company’s capital structure and risk profile.

Author Author

Growth stocks are typically valued at an implied perpetual growth rate in the 1.5% to 4% range, in line with the anticipated pace of regional and global economic expansion given the underlying companies’ higher contribution to GDP relative to value stocks with maturing prospects. Despite Snowflake’s outperforming growth trajectory in the high double-digit range relative to its tech peers, an 8% implied perpetual growth rate based on the stock’s current price levels exhibits a substantial disconnect from its fundamental prospects.

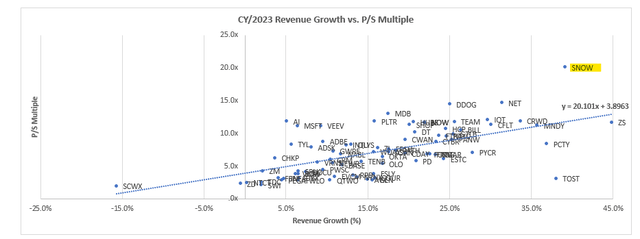

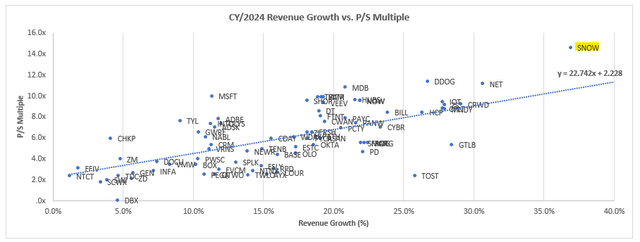

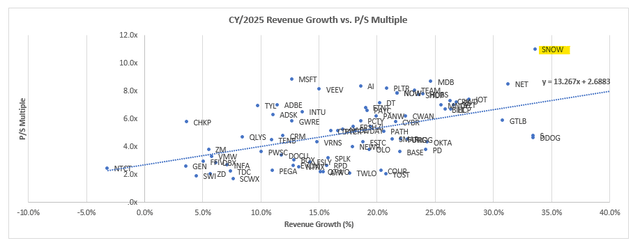

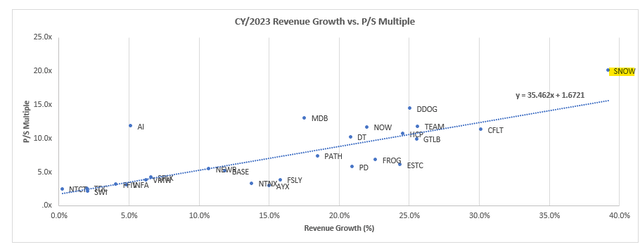

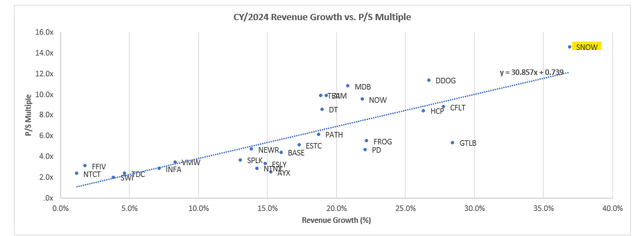

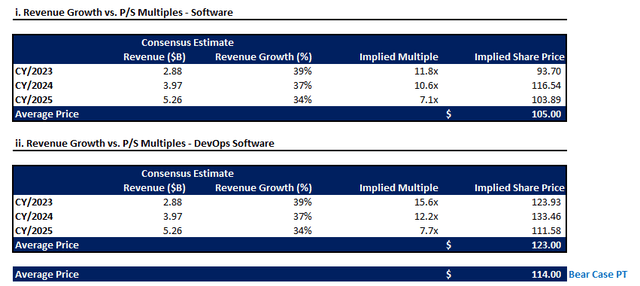

In order to better gauge a reasonable valuation range for which Snowflake should trade at, we have performed a relative valuation analysis based on peer comparables in the broader software industry as well as the dev-ops software sub-industry. This method should better reflect the premium value attributable to Snowflake considering its substantial growth relative to the broader peer group.

i. Revenue Growth vs. P/S Multiples – Software Universe

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

ii. Revenue Growth vs. P/S Multiples – DevOps Software

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

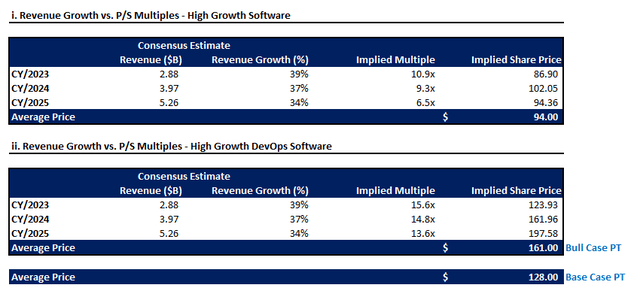

Considering both the broader software universe and dev-ops software sub-industry peer comps, Snowflake should trade closer to the $110-range on a relative basis to its rivals.

Author

However, we view this figure non-reflective of the valuation premium attributable to the company’s outsized growth prospects, considering its critical role in supporting secular growth trends in tech over the coming years, spanning data storage and compute solutions. As such, we would consider the $114 as a reasonable bear case price target to reflect Snowflake’s estimated intrinsic value in the event its competitive advantage in the provision of critical data cloud solutions for supporting increasingly complex cloud-based workloads – including generative AI and large language models which have gained substantial interest in recent months – starts to normalize. The $114 bear case price target would reflect an implied perpetual growth rate of about 7%, which is still reflective of Snowflake’s growth premium buoyed by longer-term secular growth opportunities.

Author

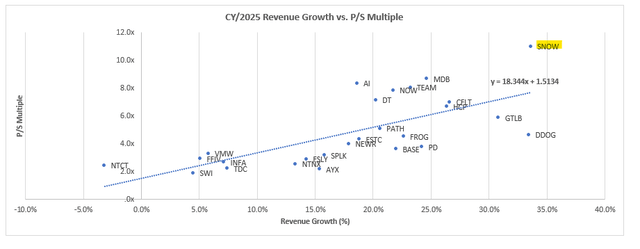

To better gauge the base case value attributable to Snowflake, we have considered its relative valuation to peers with similar growth prospects.

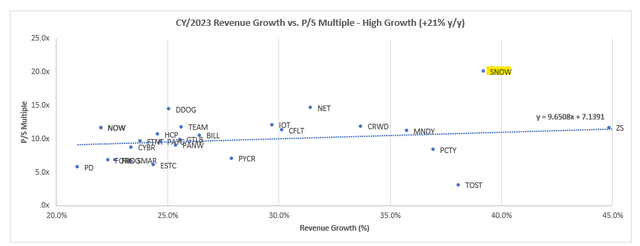

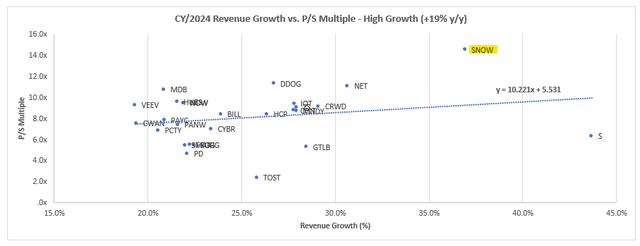

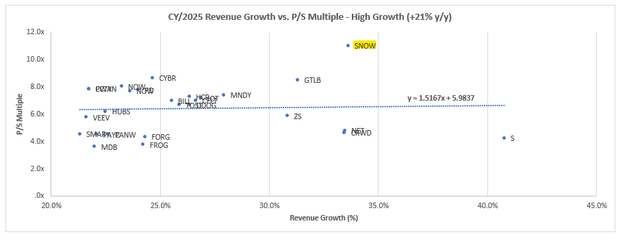

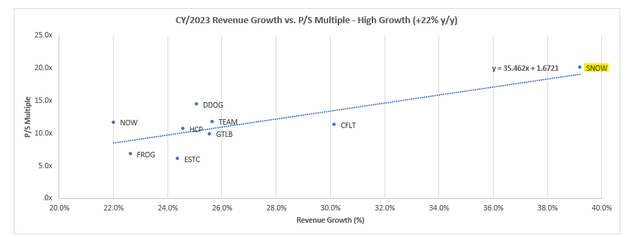

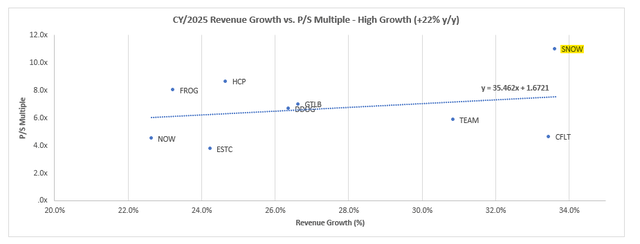

i. Revenue Growth vs. P/S Multiples – Software Universe (High Growth)

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

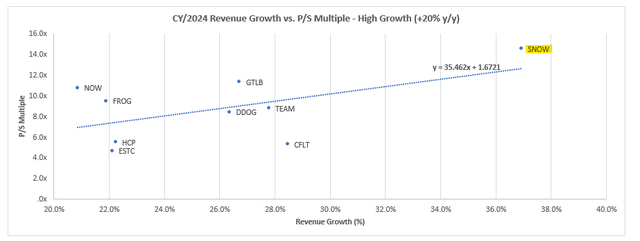

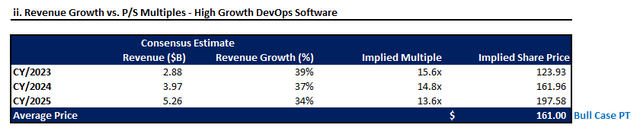

ii. Revenue Growth vs. P/S Multiples – DevOps Software (High Growth)

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

Considering the higher-growth names in both the broader software universe and dev-ops software sub-industry peer groups, Snowflake should trade closer to $128 apiece on a relative basis to rivals with a similar growth profile.

Author

We view this comparable valuation as a better reflection of the premium attributable to Snowflake’s outsized growth trajectory, as it remains early on the data cloud solutions adoption curve – more than 90% of global IT workloads have yet to migrate to the cloud, underscoring the growth headroom not yet addressed.

In the bull case scenario, Snowflake would show sustainability near the $160-level, which is closer to the stock’s current price. The figure reflects Snowflake’s estimated intrinsic value on a relative basis to its high-growth dev-ops peers, and is a reasonable representation of the company’s leading market share gains in the provision of data storage, compute and transfer solutions under the emerging consumption-based business model in software.

Author

However, considering near-term macroeconomic headwinds as well as the extended challenge stemming from a structural shift in enterprise end-market demand for cloud spend optimization, Snowflake’s growth prospects show a lack of durability in sustaining a bull case narrative. This is further corroborated by the stock’s steep decline in post-market trading immediately after the release of a disappointed forward guidance, reflecting an adjustment to market’s tempered expectations on Snowflake’s fundamental outlook.

The Bottom Line

Admittedly, Snowflake Inc.’s line of business is expected to benefit from a sticky RPO, given secular cloud migration tailwinds, as well as operational considerations, such as the costly egress fees and time-consuming process of transferring workloads between networks. The advent of generative AI and LLMs are also bolstering industry demand for data and, inadvertently, related solutions provided by Snowflake which are critical to supporting their development and deployment.

Generative AI is powered by data. That’s how models trained and become progressively more interesting and relevant. Models have been primarily trained with Internet and public data and we believe enterprises will benefit from customizing this technology with their own data. As Snowflake manages a vast and growing universe of public and proprietary data, the data cloud’s role in advancing this trend becomes pronounced.

Source: Snowflake F1Q24 Earnings Call Transcript.

However, the growing immediate risks to the durability of Snowflake’s outsized growth prospects market has currently priced into the stock’s lofty premium – in line with its downward-revised guidance for full fiscal year 2024 – is overshadowing the generative AI catalyst. In other words, continued deceleration and a weaker-than-expected growth trajectory at Snowflake represents renewed multiple compression risks facing the stock, increasing its vulnerability to the volatile market climate given persistent macroeconomic uncertainties.

Until industry’s angst over recession risks alleviate and consumption-based models recover, Snowflake Inc. growth is likely to lag market’s expectations and further weigh on the durability of the stock’s premium.

Read the full article here