Should investors be worried about the impending breach of the US debt ceiling? A default would be catastrophic, according to numerous news articles I’ve read recently. Well, to be honest, I didn’t read past the first few paragraphs of most of those articles because if you’ve read one of them, you’ve read them all. Obviously, a default would be bad, and I don’t need anyone to explain that to me. So, maybe we should concentrate on whether a default is likely rather than what the consequences of doing so would be.

Does anyone really think the politicians are going to push us to actual default? If they do, it will make it harder to borrow in the future – raise the cost. So, no, I don’t think we have to worry about an actual default. Treasuries will get paid on time.

There are other outcomes, such as a government shutdown, that could impact the economy and I wouldn’t be surprised if they push this to that point.

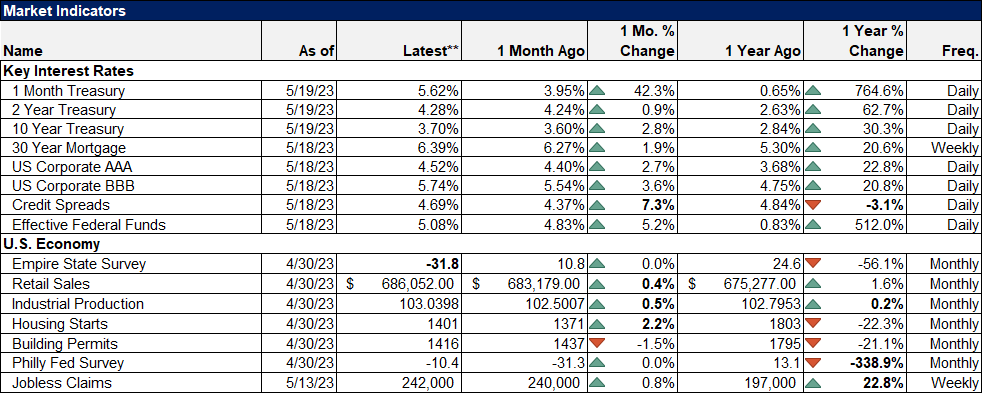

We haven’t seen a lot of market reaction to the debate, but you wouldn’t know that from the media reaction. I’ve read numerous articles that state confidently that the reason the 1-month T-Bill is trading at a higher yield than the 3-month is because investors are scared of a default in the next 30 days. I’m not sure if that makes any sense, but then no one ever said investors act rationally, except for a bunch of economists. If it is true, then the cost of default seems pretty puny, since the yield spread is a mere 50 basis points.

I’ve also read that investors are selling stocks out of fear of default. If that is true, they’ve been afraid for 11 of the last 14 months. It is true that stocks fell 15% during the debt ceiling debate of 2011, but if you’re selling based on that, you might want to think back to what else was going on back then. As I remember it, Europe was having some issues with potential actual defaults, Greece teetering on the brink. You know, a real crisis rather than a manufactured one. But, sure, blame it on the debt ceiling silliness.

I don’t know exactly how this debt ceiling standoff will end, but I am confident of two things. One, our debts will be paid. Two, the federal government will spend more next year than it does this year. Investors need to find something else to worry about.

Environment

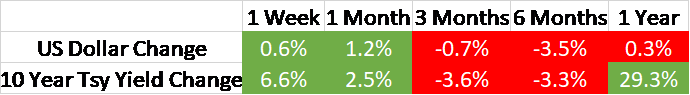

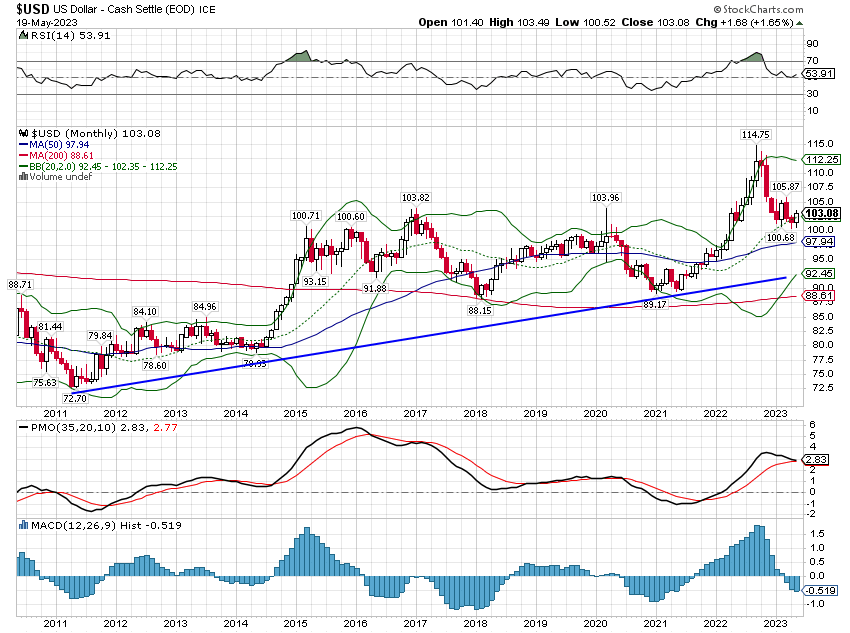

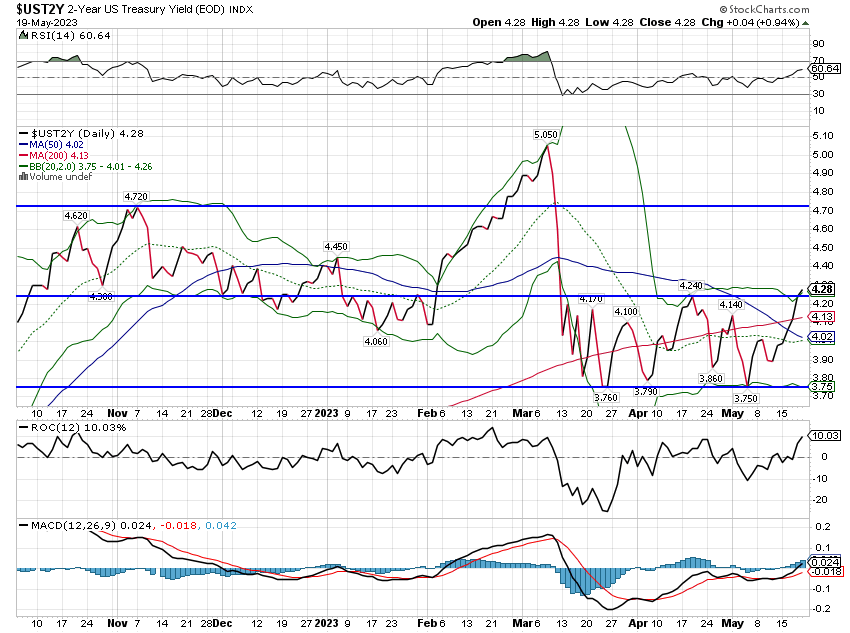

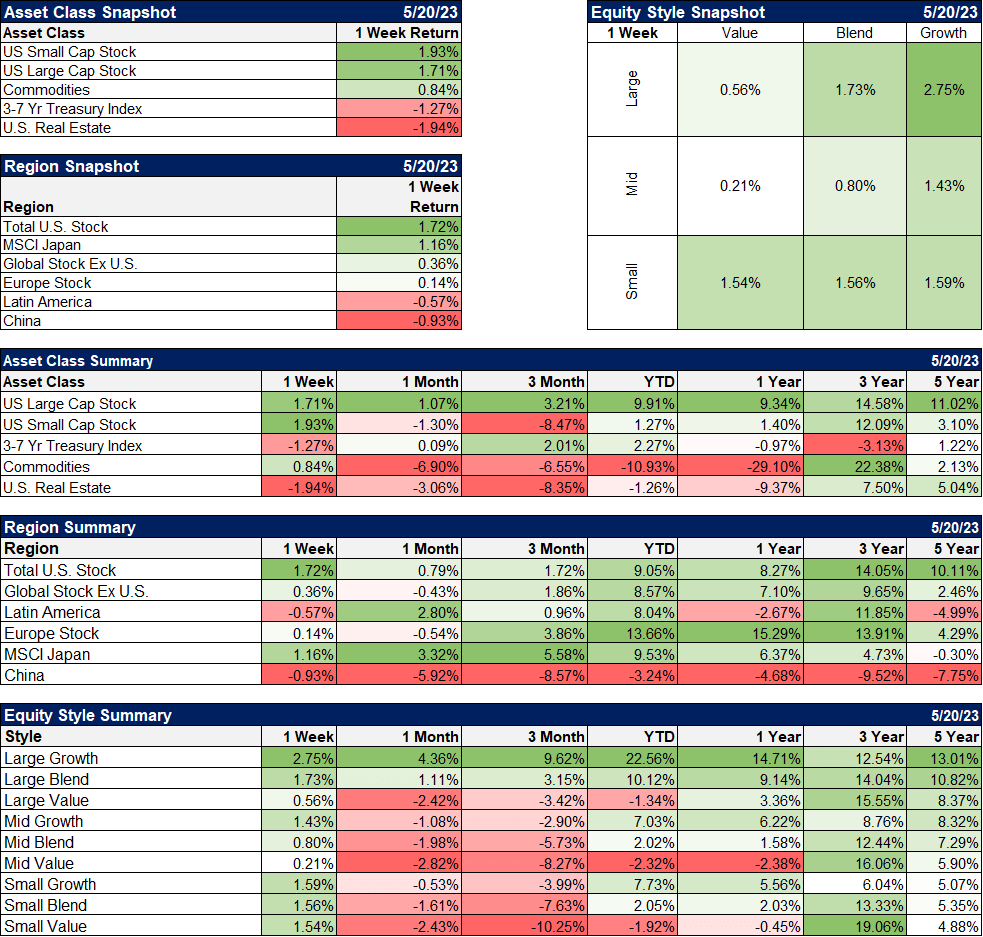

The 10-year Treasury yield and the dollar were both higher last week. The dollar has broken its short-term downtrend and can now be classified as neutral. A move up to the 104/105 area would be normal, even in the context of a developing longer-term downtrend. But we aren’t there yet; the longer-term trend of the dollar is still up.

The 10-year yield still hasn’t broken its short-term downtrend and with shorter maturities stalling out now, I am skeptical it will. The 2-year note yield hasn’t gone anywhere since October, and the 3-month bill has been stalled for about a month. I suppose rates could just be pausing ahead of another push higher, but that would probably require a resurgence of inflation. I don’t see any evidence of that right now.

This move in rates and the dollar reflect the resilience of the US economy as shown through recent economic reports. Retail sales, industrial production, and housing starts reports last week were all better than expected. Real growth is still around the trend of 2% despite the Fed’s aggressive rate hikes of the last year. Maybe the Fed is done hiking rates – for now – but it would be hard to justify rate cuts based on current information about the US economy. Meanwhile, European data has been relatively weak recently, which is driving the euro/dollar exchange rate.

Markets

Stocks were higher last week, with large-cap growth leading the way again. For whatever reason, investors seem to have gone right back to the pre-Fed tightening playbook. Over the last year, if you didn’t have a large slice of large-cap growth in your portfolio, you haven’t made much, if anything. It remains a frustrating situation for value investors, but I, for one, find the price of growth too steep to justify.

Japan continues to perform well and stocks there are still cheap, but the number of glowing articles I’ve read over the last few weeks about corporate changes in Japan gives me pause. We have been invested in Japan for years and have no plans to change that, but if you aren’t already in, I’d be cautious. I think a lot of this is people following Warren Buffett, but I’m not sure he’s making as big a bet on “Japan” as it seems. He’s invested in a few of the Japanese trading companies, but he hasn’t so far moved beyond that group.

Commodities were up on the week as crude oil and natural gas both rallied. Both, however, are still in downtrends. The rest of the commodity complex was mixed with platinum up, copper flat, and gold down 1.7% due to higher real rates.

Sectors

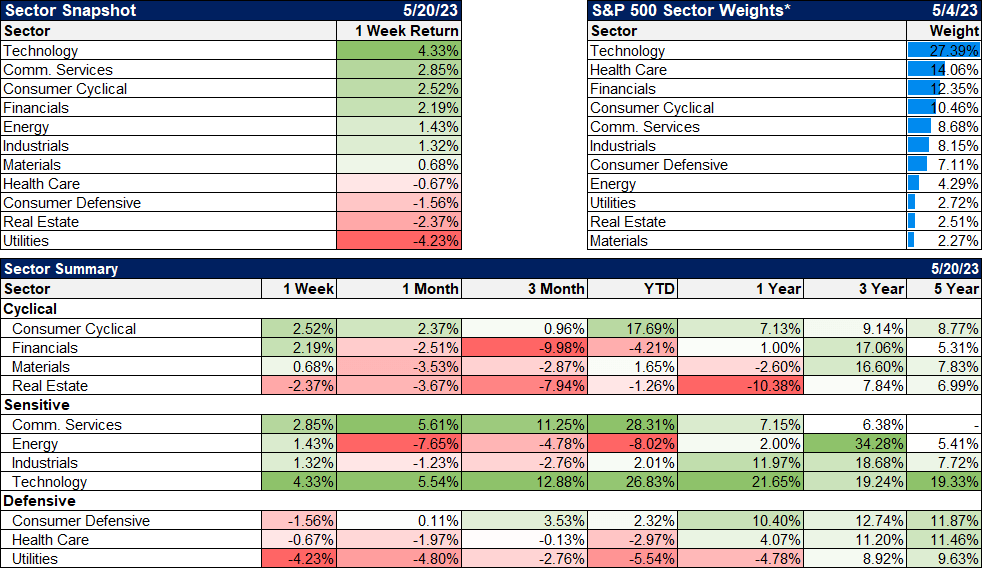

Technology and communication services continue to lead the growth resurgence of 2023. Cyclicals also performed well with good economic data, while defensive sectors were solid. Real estate was lower with higher interest rates.

Energy was also higher, and I think we can start to look at this sector again for additional investment. Crude oil, as noted above, is still in a downtrend, but the supply/demand situation is shifting with drilling for crude and natural gas both falling off rapidly. That will take time to impact end markets though, so I don’t think there’s a big rush on these stocks. On the demand side, a recession would obviously be a negative, but unless it is severe, I suspect most of that is already in the market.

Economic Indicators

Credit spreads are up this month, but of more note maybe is that they are actually down over the last year. Yes, despite repeated warnings of recession, all the doom and gloom about the yield curve, the Fed’s aggressive rate hikes, and a few bank failures, this measure of credit market stress is actually better than it was a year ago. Maybe we should just tune out all the macro commentary, stop fretting about every economic report, and pay attention to the market. Probably a good idea, and despite writing every week, what I actually try to do.

The economic data was generally better than expected last week, with some exceptions. The NY Fed’s Empire State survey fell back into negative territory after last month’s bounce. The Leading Economic indicators were also negative for the 13th straight month, something normally associated with recession. That indicator may prove prescient again, but the rest of the data shows no indication that it will be proven correct imminently.

Indeed, when you look at the totality of the economic data over the last year, there’s not a lot that looks dire. Real disposable personal income is up 4% year-over-year and real personal consumption is up 1.9%. That leads to the rise in the personal savings rate from 3.8% to today’s 5.1%. Rising real incomes, rising consumption, and rising savings sound like a pretty combination because, well, it is.

That doesn’t mean we won’t have a recession eventually, but given the actual economic situation, the negativity around the economy of the last year – or more – seems wildly misplaced. I don’t have a favorable view of most of our economic policies right now – and haven’t for some time – but I am constantly amazed at how resilient the US economy is. It really is incredible how well businesses have managed through the COVID era.

The debt ceiling debate is political, and the consequences will be political. We can only assume that cooler heads will prevail, and our debts will be paid. The consequences of not doing so, of actually withholding payments to debt holders, are unthinkable.

I don’t expect much to come of this.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here