Introduction

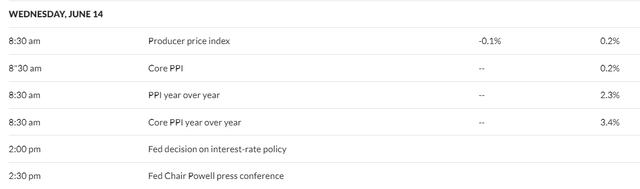

This article will be experimental – I’ll try to briefly describe the main theses of analysts from major banks on one of the most important interest rate decisions this year, which will be announced at the FOMC meeting on June 14 at 2PM.

MarketWatch

I’ve never written previews like this for a wide audience, so it’ll be interesting to get your opinion on this format. So let’s get started.

Barclays: FOMC should signal it’s not done yet

Barclays’ analysts expect [June 9, 2023 – proprietary source] that the FOMC will signal it is not done after carefully setting a course for an extended pause. Powell will likely lead the committee to an agreement that minimizes dissent, which likely implies a skip this time around. Since the May core CPI reading didn’t exceed the consensus forecast of 0.4% m/m, it’s unlikely to tip the balance to a hike. They expect the median dot to show an additional 50 bps hike in 2023, with levels in 2024 and 2025 up the same amount. The June statement is expected to be similar to May’s, with no meaningful alterations to the characterization of job gains, the unemployment rate, and inflation. For now, the analysts retain their baseline that the Fed will deliver another 50 bps hike through September, then remain on hold into Q2 2024. Although they pencil in incremental cuts over the final six meetings of 2024, the transmission of higher rates to activity is looking less potent than usual, and they view risks to the rate trajectory as tilted to the upside, even if the FOMC delivers the dot plot as expected.

Barclays [June 9, 2023 – proprietary source]![Barclays [June 9, 2023 - proprietary source]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1686719058890389.png)

Deutsche Bank: “Hike me maybe one more time”

After raising its policy rate in 10 consecutive FOMC meetings, the Fed is likely to break the pattern and not hike rates today, keeping the fed funds rate at 5.125%, Deutsche Bank analysts write in their note [June 9, 2023 – proprietary source]. However, the meeting statement, Summary of Economic Projections [SEP], and Chair Powell’s press conference are expected to lean hawkish, indicating the probable need for further tightening as early as the July 26 meeting.

One notable change DB anticipates for this meeting is that the statement will be adjusted in a hawkish manner, acknowledging the possibility of additional tightening in the “coming meetings.” The dot plot is also likely to indicate that an extra rate hike may be necessary to achieve a “sufficiently restrictive” stance. We have strong data so far, favorable financial conditions, and a desire to prevent expectations of rate cuts from rising too soon – that’s why Powell may choose to convey a hawkish message during the press conference.

Also, DB predicts that the Fed will raise rates once more in July, reaching a terminal rate of 5.3%. The analysts expect the 1st rate cut to occur in March 2024, followed by a cumulative reduction of 275 basis points next year.

Goldman Sachs: Waiting for the Haze to Clear

The leadership of the Federal Reserve has clearly indicated that they believe it is wise to temporarily pause because of concerns about the potential unintended consequences of previous rate hikes and the impact of tighter bank credit, Goldman Sachs analysts write in their note [June 8, 2023 – proprietary source].

Goldman Sachs believes that the downside risk to the economy has decreased, although there are conflicting signals in measures of activity growth. They attribute this discrepancy to gloomy business sentiment and recession fears biasing survey data lower. They place more weight on the resilient hard data, particularly the strong labor market and consumer spending.

Goldman Sachs [June 8, 2023 – proprietary source]![Goldman Sachs [June 8, 2023 - proprietary source]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1686720657363487.png)

GS is increasingly confident that the banking stress will not cause a recession, as lending standards have only modestly tightened and lending volumes have moderately declined. They have lowered their 12-month recession probability to 25%. However, due to the conflicting data and uncertainty regarding the impact of tighter credit, they understand the Fed’s cautious approach.

They note signs of cooling inflation ahead, including declining wage growth and a slowdown in leading indicators of rent inflation. Despite slower progress in realized inflation, they see less reason for Fed officials to be concerned due to normalized inflation psychology.

Goldman Sachs [June 8, 2023 – proprietary source]![Goldman Sachs [June 8, 2023 - proprietary source]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1686721022495337.png)

GS predicts one additional rate hike in 2023, reaching a new peak of 5.375%. Their forecast suggests 87.5 basis points of rate cuts in 2024 and another 112.5 basis points in 2025. Goldman Sachs maintains a more hawkish view than the market, mainly due to a lower probability of recession and a higher threshold for rate cuts.

Goldman Sachs [June 8, 2023 – proprietary source]![Goldman Sachs [June 8, 2023 - proprietary source]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1686721042645026.png)

JPMorgan’s View: No Hike This Time

While the May statement already conveyed a bias towards further tightening, JPMorgan [June 9, 2023 – proprietary source] anticipates a revision higher in the interest rate forecast “dots,” with the median Committee participant expecting one more rate hike this year. They also anticipate the possibility of at least one Committee member dissenting in favor of another hike. JPMorgan notes that the debt ceiling has been resolved, the banking crisis has remained calm, and the data have been generally positive, leading some Fed officials to speak in favor of further tightening. However, not all officials have equal influence, and Vice Chair nominee Jefferson’s remarks are seen as an indication of the Chair’s inclination for the meeting. JPMorgan expects the post-meeting statement to convey the sentiment that holding rates constant does not mean reaching the peak rate for this cycle. They anticipate similarities between the upcoming statement and the previous one, with a discussion of the economy’s modest growth, strong job gains, low unemployment, and elevated inflation. JPMorgan believes some Governors and reserve bank presidents may prefer a rate hike but anticipate that dissent is unlikely. In terms of the Summary of Economic Projections [SEP], they expect revisions to the unemployment rate and GDP growth forecast. The median dot for this year may move higher, reflecting the strength of the labor market and potential revisions by some officials. However, JPMorgan does not anticipate a significant upward revision. Powell’s task in the press conference will be to emphasize that a decision to leave rates unchanged does not rule out future rate hikes.

Morgan Stanley

The bank expects the Federal Reserve to maintain the policy rate steady at 5.1% and retain a tightening bias. The analysts believe [June 9, 2023 – proprietary source] that the data will not meet the threshold for a rate hike in July, and the Fed will likely extend the hold until the first cut in 1Q24.

According to Morgan Stanley, market participants have already overpriced the prospects for a rate hike. They believe that economic data will further slow down, which will limit the case for a July hike. Even if the case for one more hike builds over the coming weeks, it is already 75% priced in, and the risk/reward for further hikes looks diminished. Looking beyond the pricing for the June and July rate hikes, markets only price in about a 28 bps cut below the peak rate by the end of 2023.

Morgan Stanley [June 9, 2023 – proprietary source]![Morgan Stanley [June 9, 2023 - proprietary source]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-16867218861266403.png)

Morgan Stanley’s strategists advocate for staying neutral on US Treasuries and maintaining long USD positions. Their bullish USD view is based on the belief that markets have priced in optimistic outcomes in the US, such as declining inflation and potential Fed rate cuts, while growth remains supported.

Morgan Stanley [June 9, 2023 – proprietary source]![Morgan Stanley [June 9, 2023 - proprietary source]](https://wealthbeatnews.com/wp-content/uploads/2023/06/49513514-1686722386611343.png)

In terms of the SEP, they expect little change, except for a downward revision to the unemployment rate forecast. They see a high bar for the Fed to resume hiking post-June and expect an extended hold before the 1st rate cut in 1Q24.

Summary

As you can see, the banks’ views vary, but overall, there is an expectation that the FOMC will signal a pause in rate hikes for now while maintaining a tightening bias for the July meeting.

Thanks to recently released inflation data, it’s becoming increasingly clear that the consensus is likely to win this time – I expect the FOMC to actually skip a rate hike this time.

Inflation seems to have been defeated, and that seems to be a self-evident conclusion today. But it also implies that companies will be less able to maintain marginality levels, and given the lagging nature of pricing, current predictions of a significant improvement in EPS soon strike me as window dressing. That’s a whole other story that I’ll probably write a separate article about soon, but if it turns out to be true, then regardless of the FOMC’s decision this time around, the market is going to have to work hard to maintain today’s growth rates for the foreseeable future.

Read the full article here