I’ve written 3 articles about Wheeler REIT (NASDAQ:WHLR) in the past twelve months, and this could be my last. The deadline for the Series D preferred (NASDAQ:WHLRD) dilution apocalypse is upon us, with those shares being convertible into cash or common shares starting September 21, 2023. Little time remains for a deal to get done, and if none transpires, I expect significant selling pressure across the Wheeler share classes.

Background

Please peruse my past three articles for details on the transformative Cedar acquisition, initial D share tender, and subsequent revised tender. With both tenders failing, Wheeler is careening towards a death spiral of share issuance that should make the common un-investable.

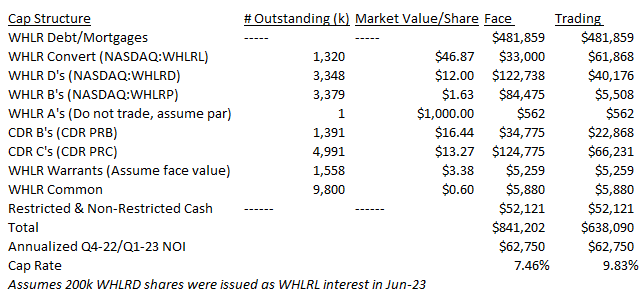

I have updated my table from prior articles with the current prices and outstanding quantities of key Wheeler share classes, which is important context for what follows:

Author Calculations

Looming WHLRD Conversion

Per the latest 10-Q:

After September 21, 2023 (the “Series D Redemption Date”), the Series D Preferred Holders will have the right to cause the Company to redeem their Series D Preferred at a price of $25.00 per share plus the amount of all accrued and unpaid dividends. This redemption price is payable by the Company, at the Company’s election, in cash or shares of our common stock, $0.01 par value per share (“Common Stock”), or a combination of cash and shares of Common Stock.

…

We anticipate that, in the event of the Series D Preferred Holders’ exercise of such redemption rights after the Series D Redemption Date, the Company will not have sufficient available cash to pay the aggregate redemption price. Accordingly, in such event, we will not be able to meet our redemption obligation without either liquidating assets or issuing significant additional amounts of Common Stock.

The Company does not believe it is in its interests to liquidate assets or incur indebtedness to fund cash redemptions of the Series D Preferred Stock and, accordingly, it has no intention of doing so. Therefore, the Company will likely be required to settle redemptions of Series D Preferred following the Series D Redemption Date in Common Stock.

What do the mechanics of this conversion look like?

-

Deliver notice on the 25th of the month, for redemption on the 5th of the following month (or subsequent business day) along with a disclosure on number of common shares already held by the individual.

-

Conversion price for common shares will be the Volume-Weighted Average Closing Sale Price (VWAP) for the interim time between notice being given and redemption date

-

Example: Bill delivers redemption notice for 1,000 shares of WHLRD on September 25th. With $37 face value and VWAP closing price of $0.60 on WHLR shares during the interim period, Bill would receive 61,667 shares of WHLR common stock on October 5th. Bill would then be able to hold his shares or sell them in the open market after they are delivered.

There are multiple issues here.

-

First – if a mere 1% of Series D holders deliver a redemption notice (~33k WHLRD shares), the total common shares issued in the above scenario will be 2.0m – 20% of the current number outstanding. 750k shares are currently available to short, so initially one could partially hedge the conversion. But it would be hard to match up anticipated conversion price with # of shares short and would be forced to carefully track price movements for any unexpected price action before the conversion.

-

Secondly, it is likely the WHLR common share price will have no bid in this scenario – who is buying a stock that currently does an average of 65k shares of volume per day with millions of new shares coming to the market in the near future? If you lower the VWAP price to $0.25, now 5.0m shares are set to be created. But what stops it there? I expect competition for shorting common shares will also get more intense after September, creating more downward pressure before conversions.

-

Next, the Wheeler charter limits ownership to 9.8% unless you have a waiver. In the $0.25 scenario, you could deliver 10k WHLRD shares for conversion, less than a third of 1% of the outstanding WHLRD issue, and still be at risk of tripping the ownership limit. Imagine what happens if VWAP goes even lower, like $0.10 – a couple thousand WHLRD shares would be at risk of hitting ownership limits in the first round of conversions. It doesn’t seem clear to me if this scenario results in your conversion request being rejected, or the excess shares simply being created and donated to a charitable trust, per the Wheeler charter. But a loss of your investment seems possible if your converted shares violate the ownership limit, leading to an inability to convert a meaningful number of D shares.

-

After a few rounds of these conversions and millions of new WHLR common shares looking to be sold without a bid, I expect Wheeler will quickly max out their authorization for common shares, which is 200m. Worse still, this may happen without a meaningful reduction in WHLRD shares if conversions are being done at sub 10 cent VWAPs.

-

If all 200m authorized shares have been issued, the company has already made it clear they do not intend to fund further redemptions with cash. Perhaps a court could compel them to after another long slog of litigation, but Wheeler has won most of their court battles to date, given the extreme flexibility of Maryland REIT law. If any large holders had confidence they could force cash redemption, I would expect a bid in the market for shares well north of $12.

-

If D shares sell off because of the difficulties converting them, then future dividends on the Wheeler L Notes (NASDAQ:WHLRL) can be paid in very cheap Ds, shifting the net ownership of the issue, allowing for a future deal to be made with holdouts having less voting power. Instead of a tender offer for $16 of notes and half a common share, they could find themselves getting far less.

The reasons above seem to explain why a $37 liquidation preference security continues to trade around $12 even as the conversion catalyst approaches. Holders are realizing that converting a token amount of WHLRD shares could result in more issues than benefits, and large holders will have no meaningful route to exercise their right.

So What?

With the Wheeler dilution day of reckoning approaching, the lack of bid for both common shares and D shares seems to be confirming a worst-possible outcome is approaching – massive dilution with little benefit for any stakeholders. It would be an unfortunate chapter in Joe Stillwell’s otherwise successful activist career and a needless waste for current D holders who refused recent tender offers. Even worse, this saga continues to obscure operating results that have been very good at the Wheeler entity level. Two months remain for some kind of compromise to emerge, but hope is fading by the day.

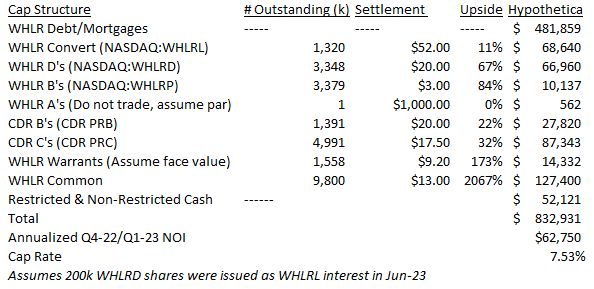

A world exists where all investors in Wheeler could walk away happy. If the $16/share WHLRD offer could have been increased enough to induce a successful exchange, say, $20 (67% upside to current price), and WHLRP shares were subsequently tendered for $3 (82% upside to current price), everyone remaining could still earn a substantial return from current trading prices and value the entity at a reasonable 7.5% cap rate:

Author Calculations

Instead, common shares are set to essentially be diluted to zero, after which D holders will likely need a vote of the newly minted common shareholders to try to advance their interests. Good luck getting them to vote to dilute themselves further. If they effectively cannot convert their D shares, some holders are likely to throw in the towel and move on, and I do not know who the natural buyer will be for those D shares either.

Conclusion

With the deadline approaching, panic seems to be setting in for Wheeler stakeholders. Common shares have been hammered, but they have not seen anything yet if September arrives without a deal. The Series D shares’ contractual liquidation value is not enticing buyers at $12, despite the impending catalyst, a price which that current holders may soon long for, compared to the gyrations required to effectively convert their shares to common stock. I own a token position in the common and B share issue in hope of a deal, but that hope fades a little more each day.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here