I want to be brief here, so let me just say that East West Bancorp (NASDAQ:EWBC) is one of the most attractive banks available in the U.S. market. The bank has a strong franchise, a diversified business model, a robust balance sheet, and a proven track record of growth and profitability. East West Bank also has a unique competitive advantage in serving the Asian-American community and facilitating cross-border trade and investment between the U.S. and China.

East West Bank just so happens to be the largest publicly traded bank in Southern California, with over 120 branches across nine states and four international locations. The bank offers a healthy range of personal and commercial banking, home loans, wealth management, and international banking services to its customers. East West Bank has a loyal and growing customer base, with over $64 billion in total assets and over $55 billion in deposits as of March 31, 2023.

One of the reasons why East West Bank is undervalued is that many investors and analysts overlook it. The bank does not receive much media attention or analyst coverage, despite its strong fundamentals and growth prospects. However, some savvy investors have recognized the value and potential of East West Bank and have been buying its shares.

Li Lu is the founder of Himalaya Capital Management and a trusted partner of Charlie Munger, the legendary vice chairman of Berkshire Hathaway (BRK.A)(BRK.B). Munger has given Lu the highest compliment by calling him “The Chinese Warren Buffett” and entrusting him with his personal wealth – something he has only done once in his 99 years. Lu has a knack for finding long-term value opportunities and a deep understanding of China and Asia. He initiated a stake in East West Bank in the first quarter of 2023, snapping up almost 2.30 million shares at an average price of $55 per share.

Li Lu’s stake in East West Bank is a powerful signal of the bank’s quality and value. It also shows his conviction in the bank’s skill to handle the risks and rewards in the U.S.-China relationship, which is a crucial driver for East West Bank’s growth.

East West Bank is a unique opportunity in the banking sector that delivers growth, value, profitability, stability, and competitive edge. The bank stands to gain from the demographic trends, and the rising trade and investment flows between the U.S. and China.

If you are looking for a top-notch bank stock with massive upside potential, you should grab East West Bank at its current steal price.

EWBC’s Unique Growth Prospects

EWBC has a loyal and diversified customer base of individuals, businesses, and institutions that value its cultural understanding, language capabilities, and specialized products and services. The bank has a leading market share in key metropolitan areas with high concentrations of Asian Americans, such as Los Angeles, San Francisco, New York, and Seattle. The bank’s corporate profile asserts that “East West is the leading bank serving the Asian community in the U.S.”

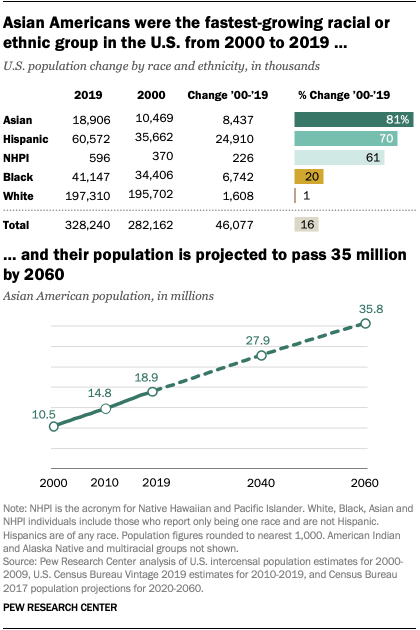

EWBC has a unique competitive advantage in its niche market of serving the Asian American community, which is one of the fastest-growing and most affluent segments in the U.S. According to the U.S. Census Bureau, the Asian American population grew by 28% from 2010 to 2020, compared to 7.4% for the total U.S. population.

Pew Research

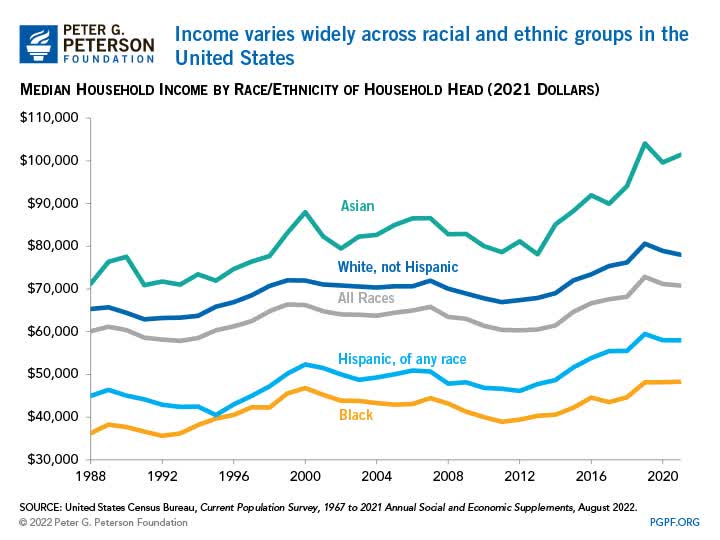

This demographic is also the single most affluent in the country. The median household income for Asian Americans was $98,174 in 2019, compared to $68,703 for the total U.S. population. It should go without saying, but this bodes well for the bank’s deposits.

PGPF.org, United States Census Bureau

EWBC also has a strong presence in Greater China, with branches in Hong Kong, Shanghai, Shantou, and Taipei, and representative offices in Beijing, Chongqing, Guangzhou, Xiamen, and Shenzhen. The bank leverages its cross-border expertise and network to facilitate trade and investment flows between the U.S. and Greater China, as well as to serve Chinese companies and individuals operating or investing in the U.S.

EWBC has ample opportunities to grow its loan portfolio, deposit base, fee income, and market share in both its domestic and international markets. The bank has expanded its branch network, digital capabilities, product offerings, and customer segments to capture more business opportunities and enhance customer loyalty.

EWBC’s Superior Profitability and Efficacy

EWBC has consistently delivered solid profitability and efficiency metrics over the years.

| Profitability Metrics | EWBC | Industry |

|---|---|---|

| Return on assets (ROA) | 1.9% | 0.98% |

| Return on average equity (ROE) | 20.72% | 10% |

| Net interest margin (NIM) | 4.24% | 2.97% |

| Loan/Deposit Ratio | 84% | 62% |

The above chart shows that EWBC is a highly profitable and efficient bank that outperforms the industry average on several key metrics. EWBC has a strong competitive advantage in serving the Asian American market, which is the fastest-growing and highest-income racial group in the U.S. EWBC leverages its unique cross-border banking capabilities, its loyal customer base, and its diversified loan portfolio to generate superior returns for its shareholders.

EWBC’s return on assets (ROA) of 1.9% is almost double the industry average of 0.98%, indicating that the bank is very effective in using its assets to generate income. This reflects EWBC’s ability to maintain high asset quality, low operating expenses, and strong fee income from its wealth management and treasury services.

EWBC’s return on average equity (ROE) of 20.72% compared to the industry average of 14%, indicating that the bank is very profitable for its shareholders. This reflects EWBC’s ability to leverage its capital efficiently, grow its earnings consistently, and pay out dividends regularly.

EWBC’s net interest margin (NIM) of 4.24% is significantly higher than the industry average of 2.97%, indicating that the bank has a high spread between its interest income and interest expense. This reflects EWBC’s ability to attract low-cost deposits from its Asian American customers, who tend to have higher savings rates and lower default rates than other groups. It also reflects EWBC’s ability to lend at higher rates to niche segments such as commercial real estate, entertainment, and technology.

EWBC’s loan/deposit ratio of 84% is higher than the industry average of 62%, indicating that the bank is more aggressive in lending out its deposits. This reflects EWBC’s confidence in its credit underwriting and risk management practices, as well as its growth opportunities in both the U.S. and China markets.

Overall, the chart shows that EWBC is a well-managed and well-positioned bank that has a clear competitive edge in serving the Asian American community. The bank has a solid track record of delivering superior financial performance and shareholder value, and has ample room for further growth and expansion.

EWBC’s strong profitability and efficiency are driven by its diversified revenue streams, disciplined expense management, prudent risk management, and robust capital position. The bank generates revenue from both interest income and non-interest income sources, such as wealth management fees, foreign exchange fees, letters of credit fees, swap fees, and other service charges.

The bank also keeps its operating expenses under control by optimizing its branch network, leveraging technology, and streamlining processes. The bank manages its credit risk by maintaining a high-quality loan portfolio with low non-performing assets and net charge-offs ratios. The bank also maintains a strong capital position that exceeds regulatory requirements and provides flexibility for growth.

EWBC’s Extreme Undervaluation

First, we can take a look at the most relevant valuation insights.

- P/E of 5.68

- P/B of 1.09

- Tier 1 Capital Ratio (12.70%)

My favorite of all, the bank nearly trades at its tangible book value per share, which is about $42.46. Now on to my valuation; for banks, I tend to prefer the Excess Return Model for valuation rather than a DCF. I performed my model as follows:

I Found the current equity capital of EWBC. This is the book value of equity or shareholders’ equity reported on the balance sheet. As of March 31, 2023, EWBC had a total equity of $6,018 million.

I looked at the projected ROE and COE of EWBC. You can use historical data, analyst estimates, industry averages, or other methods to estimate these values. For simplicity, I will use the ROE and COE reported by Yahoo Finance EWBC had a trailing 12-month ROE of 16.95% and a COE of 9.00%.

Then, I used the expected growth rate of EWBC’s equity capital. For simplicity, I will use the EPS growth rate assumption of 12.5%.

Next up, I calculated the excess return for each year of the forecast period. I used a five-year forecast period (2023-2027). The formula for excess return is: Excess Return = (ROE – COE) x Equity Capital.

I Calculated the terminal value of EWBC’s excess returns. I used the perpetual growth method with a terminal growth rate of 3.0%, which is slightly higher than the long-term inflation rate. The formula for terminal value is: Terminal Value = Excess Return x (1 + Terminal Growth Rate) / (COE – Terminal Growth Rate)

Discounted the excess returns and terminal value to their present values using the COE as the discount rate. The formula for present value is: Present Value = Future Value / (1 + Discount Rate) ^ Number of Periods

Summed up all the present values of excess returns and terminal value to get the present value of expected excess returns.

Added the current equity capital and the present value of expected excess returns to get the value of EWBC’s equity.

Divided the value of EWBC’s equity by the number of shares outstanding to get the intrinsic value per share.

Here are the results of my excess returns model on EWBC:

- The current equity capital of EWBC is $6,018 million.

- The projected ROE and COE of EWBC are 16.95% and 9.00%, respectively.

- The expected growth rate of EWBC’s equity capital is 12.5%.

- The excess returns for each year of the forecast period are:

| Year | Equity Capital | Excess Return |

|---|---|---|

| 2023 | $6,770 | $539 |

| 2024 | $7,617 | $605 |

| 2025 | $8,570 | $678 |

| 2026 | $9,642 | $759 |

| 2027 | $10,847 | $849 |

The terminal value of EWBC’s excess returns is $15,098 million.

The present values of excess returns and terminal value are:

| Year | Excess Return | Present Value |

|---|---|---|

| 2023 | $539 | $494 |

| 2024 | $605 | $509 |

| 2025 | $678 | $520 |

| 2026 | $759 | $529 |

| 2027 | $849 | $537 |

| TV | $15,098 | $8,824 |

The present value of expected excess returns is $11,413 million ($494 + $509 + $520 + $529 + $537 + $8,824).

The value of EWBC’s equity is $17,431 million ($6,018 + $11,413).

The intrinsic value per share of EWBC is $122.71 ($17,431 / 142.1).

The current share price of EWBC is $48.50. Therefore, EWBC is undervalued by 153% based on my excess returns model.

I assign a buy rating at present levels and consider this investment a long-term holding. Investors interested in EWBC should be prepared to hold it for 5 years, give or take.

The Buffett Bonus

The Cherry on top of this compelling case is Li Lu’s newly initiated position in EWBC.

Li Lu’s investment in EWBC also gives the bank a potential connection to Warren Buffett and Berkshire Hathaway, which could open up more opportunities for growth and collaboration. Warren Buffett has expressed his admiration for Li Lu and his investment skills and has said that he would be happy to have Li Lu manage some of Berkshire Hathaway’s money.

EWBC is one of the few banks that has attracted the attention and investment of Li Lu, who is widely regarded as one of the best investors in the world and a possible successor of Warren Buffett. This is a bonus for EWBC shareholders, who can benefit from Li Lu’s expertise, insight, and influence.

Insiders have also proved to have significant confidence in the stock, with over 2.1 Million in insider share buying in the last 3 months.

Risks

This would not be a proper write-up if it did not include any potential risks to your investment. I identified two very real threats to EWBC stock over the mid to long term.

Elevated Operating Expenses: EWBC’s operating expenses have been rising over the past several years, mainly due to higher compensation and employee benefit costs, which account for about 60% of its total non-interest expenses. The bank expects adjusted non-interest expenses (excluding tax credit investment & core deposit intangible amortization) to increase 8-9% this year, which could hurt its profitability and efficiency. The bank faces pressure to invest more in technology, compliance, and marketing to remain competitive and meet customer expectations, which could further increase its costs. The bank also faces regulatory and legal risks that could result in fines, penalties, or litigation expenses.

U.S.-China Trade Tensions: EWBC’s business is highly dependent on its cross-border expertise and network between the U.S. and Greater China, which accounts for about 20% of its total loans. The bank facilitates trade and investment flows between the two regions, as well as serves Chinese companies and individuals operating or investing in the U.S. However, the relationship between the U.S. and China has been strained by trade disputes, geopolitical conflicts, human rights issues, and cybersecurity threats. Any escalation of tensions or imposition of sanctions or tariffs could adversely affect EWBC’s cross-border activities and revenues, as well as expose it to currency fluctuations and political risks.

Conclusion

EWBC is a classic example of the baby being thrown out with the bathwater. This is a rare opportunity for investors to scoop up a bank with superior growth, a solid moat, and confidence from management and Himalaya Capital. I recommend shares be acquired at present values to capture a significant margin of safety.

Read the full article here