In my last review of World Wrestling Entertainment (NYSE:WWE), I upgraded the stock to a “Hold” rating, citing the following

“If you hold the stock but don’t have much gains, stay put. The rumored takeover price targets at $95 and $105 offer the potential for a quick 20% to 30% gain in the speculated three-month time period by which the sale could materialize.”

In hindsight, I am glad I made this recommendation, as that is precisely what has happened. The stock is trading at $105.87 buoyed by the Endeavor deal. Where does that leave the stock now? Is there immediate upside potential? What about the longer term? Let’s find out, but before that, a quick refresher on the Endeavor deal.

WWE All Time Highs (Seekingalpha.com)

Introducing First, From Beverly Hills, California

Okay, I got a little carried away with what WWE-like introduction of this section. Endeavor Group Holdings, Inc. (EDR) is a publicly-listed holding company. Endeavor’s proposed merger with WWE is expected to create a new $21 billion company, with WWE shareholders getting to own 49% of the new company and endeavor holding a slight majority at 51%.

For sports entertainment fans like myself, this will bring together an extremely talented group of entertainers from WWE and UFC (Ultimate Fighting Championship). The two companies have already seen real-life and reel-life synergies and competition. For example, long term fans like myself may recall that Ken Shamrock was the first big star to get involved in both mixed martial arts and professional wrestling. However, it was Brock Lesnar who made the headlines with his move to UFC in 2008. Since then, many other famous names from both brands have made appearances in the other, including Ronda Rousey and CM Punk.

In short, I am personally excited at the potential in-ring and storyline synergy that materialize after this merger. But does that mean I am excited about WWE’s stock right now? Let’s get into the details.

All-Time Highs With Rich Valuation

A stock being at all-time highs is not enough reason to sell it. I get it. If that were the case, the likes of Amazon.com (AMZN) and Apple Inc. (AAPL) would not have created as many multi-millionaires as they likely have done. But WWE is a different type of business.

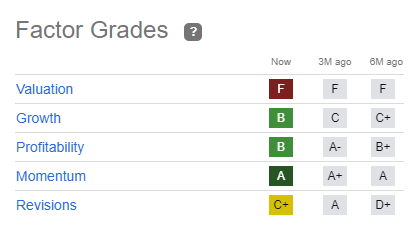

But the biggest concerns here are the stock’s current valuation and short to medium term prospects. While I am a proponent of buying and holding stocks of strong companies that can weather most economic conditions, WWE, unfortunately, is not an all-weather company. It is a cyclical, entertainment company. Sure, we can talk about content being king, but at the end of the day, it is entertainment. And people’s entertainment budgets only go far during tough times. I completely agree with the Seeking Alpha Quant “F” rating on the stock’s valuation, given the forward PE of 41.

WWE Stock Grades (Seekingalpha.com)

Buy The Rumor Sell The News

One of the biggest reasons in recent time to own WWE stock was the enticing possibility that Vince McMahon was finally willing to sell the company. With that coming to fruition, well sort of with a merger, there is no immediate catalyst I can think of to reward investors in the short to medium term. At least not when the stock is as richly valued as it is right now.

Yield, What Yield?

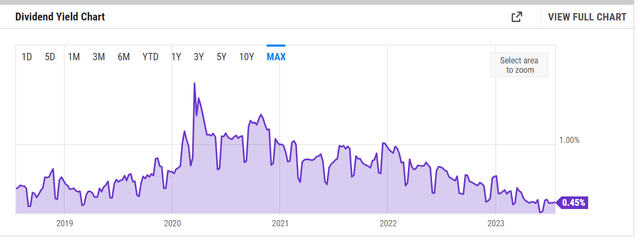

Not that too many investors hold this stock for its dividend, but the stock’s yield since June 2023 is the lowest it has been in the last five years. Although WWE has paid dividends since 2006, the company slashed its dividend by 1/3rd in 2011 and has maintained the same dividend since. So, there is no history nor expectation of dividend growth. It may not be far-fetched to say that dividends may not be the highest priority in the new company’s mind post-merger.

WWE Yield (YCharts.com)

Same Old, Same Old?

The skeptic (or realist, having been following WWE for decades) in me believes the news that Vince McMahon is slated to be the executive chairman of the merged company is not necessarily good news. As much as Mr. McMahon deserves credit for creating the global entertainment monster that WWE is today, he is also known to be resistant to changes and ideas that don’t come from himself. Make no mistake about it, it is great to have a visionary and hard-nosed founder still running a company after decades at the top, but not when he is 3 years shy of turning 80 in my opinion. The “who next” question in at least the WWE part of the new company remains to be solved, with Paul Levesque (AKA Triple H), Stephanie McMahon, and Nick Khan all being at the helm officially or unofficially at some point in the recent past.

Conclusion

As excited as I am with some fantasy booking in my mind, I completely agree with ESPN’s assessment here that the two products (WWE and UFC) won’t change drastically, if at all. With the stock reaching my predicted price target of $105, I am downgrading WWE to “Sell”. Assuming the merger does indeed go through, I will be watching how the new company performs – both as a potential investors and as a fan.

What do you think of WWE stock here and more importantly, about the proposed new company? Please share your thoughts below.

Read the full article here