June 13th proved to be a rather interesting day for investors who are largely focused on industrials and most anything related to industrials. After China’s central bank decided to cut its seven-day reverse repurchase rate by 10 basis points, in what has been an early sign of the country easing its monetary policy in light of a slow recovery following the COVID-19 pandemic, shares of certain industrial oriented stocks shot higher. Perhaps the most significant ETF that demonstrates this move is the Materials Select Sector SPDR Fund ETF (NYSEARCA:XLB). It popped higher to the tune of 2.3% for the day at a time when the broader market, as measured by the S&P 500, rose only 0.7%. This is a rather significant return disparity when you consider that, prior to this move higher, the XLB was up only 2.3% so far this year compared to the 14.3% increase seen by the S&P 500. If further easing does come to pass, then it could bode well, not only for the XLB and its component stocks, but also for the investors in them.

China has a problem

There were a few different ways to deal with the COVID-19 pandemic. One of these was an extended lockdown on the economy. While this approach had its pros, it also had its cons. The downside to this strategy was that it resulted in longer term economic pain. For instance, in 2022, the rest of the world was already rebounding nicely. In the US, for instance, GDP grew by 10.7% in 2021 and a further 9.2% in 2022. For context, real GDP growth in those years was 5.7% and 2.1%, respectively. In China, on the other hand, constant dollar GDP growth came in at 3%. With the exception of 2020 when it experienced a rise of only 2.2%, this was the slowest growing year that the company had on record since 1976.

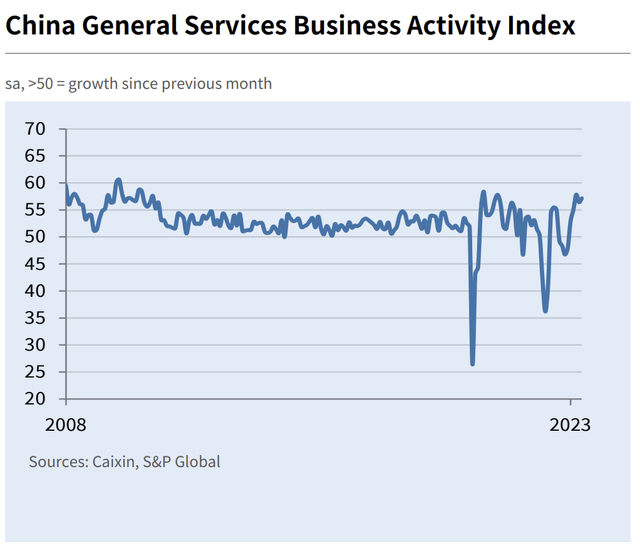

S&P Global

The hope amongst officials in China was that 2023 would mark a significant turnaround for the country. After all, it wasn’t so long ago that the country was experiencing consistent GDP growth in excess of 5% per annum. This is not to say that there have not been bright spots for the country. Services and consumption data, for instance, has been quite strong for the country. In the month of May, as an example, the Caixin/S&P Global services purchasing managers index came in at 57.1. That was up from the already solid 56.4 reported for the month of April.

It is worth mentioning that this particular index comes not from the government, but instead from the private sector. The official government data actually showed that May was a bit weaker, falling from 56.4 in April to 54.5 last month. But still, any number above 50 indicates economic expansion, which is a positive for the country and the world. Retail sales data came in at a very strong 18.4% in April. Though even that fell short of the 21% that economists had forecasted.

There were multiple problem areas when you look at the data. But the most significant was definitely industrial production. During the month of April, which is the most recent month we have data for, industrial production grew only 5.6%. That’s just above half of the 10.9% that economists were hoping for, though it was up nicely compared to the 3.9% experienced one month earlier. This is a big problem for the country because, even though the nation is moving in the direction of greater services, the powerhouse of its economy is still industry. When you add construction into the mix, somewhere around 40% of the country’s GDP comes from industrial activities.

Recognizing that this slower growth jeopardizes the country’s overall growth, China’s central bank made the decision to cut its seven-day reverse repurchase rate by ten basis points from 2% to 1.9%. For those who watch the country closely, this should not have been much of a surprise. After all, on June 8th of this year, the country’s six state owned commercial banks cut demand deposit interest rates from 0.25% to 0.20%. Other modifications were made as well. For instance, those same banks cut rates for five-year time deposits from 2.65% to 2.50%. Cutting interest rates can be an important tool for central banks. After all, when interest rates are cut, spending and various types of investments become more attractive as opposed to merely saving capital. Loans become more likely to be made because demand for capital increases as well. The hope is that, by keeping interest rates lower, the country can spur additional spending that should push industrial activity higher.

The market’s response

The aforementioned interest rate cut imposed by China’s central bank was the first such cut since August of last year. I very much doubt that it would be the last. This is a short-term interest rate that was cut. It is highly probable that the country will soon cut medium term interest rates as well. By applying interest rate cuts in a way that focuses on longer periods of time, you ideally push the yield curve down some. When this does occur, it incentivizes longer term decisions by institutions and individuals.

Already, interest rate cuts are being perceived by market participants as a big positive for various companies. Those that are focused on the industrial sector, for instance, are already reaping big benefits. As I mentioned earlier in this article, the XLB popped higher for the day. Although not as impressive, the Energy Select Sector SPDR Fund ETF (XLE) also performed well during the day, popping up about 0.5%. However, my focus from here on out will be on the XLB.

State Street Global Advisors

I decided to look at the ETF through two different lenses. The first involved some of the largest components of it. As you can see above, the 10 largest of the 29 holdings in the ETF currently account for 64.96% of its overall value. The largest component, by far, happens to be Linde plc (LIN) at 20.06%. During the day, it moved higher to the tune of 3.1%. This makes a great deal of sense. If China is successful in spurring industrial growth, the industrial gases that the company produces should be in greater demand. Based on data from last year, 19.4% of the firm’s revenue and 21% of its profits came from the Asia Pacific region.

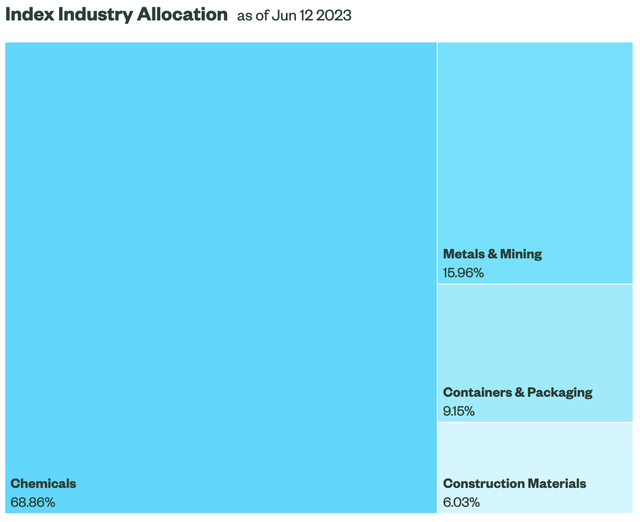

The other lines that I looked at the picture through involved the sector or industry composition of the XLB. 68.86% of it is weighted toward chemicals. Another 15.9% is weighted towards metals and mining activities. Containers and packaging comprise 9.15%, while 6.07% involves construction materials. Again, all of these are things that happen a great deal in China and that a strong China would result in greater demand for.

State Street Global Advisors

We need to be mindful that an improvement in China does not mean an improvement for China own life. As an example, the country is responsible for about 1.11 billion tons of steel production each year. That’s about 54% of global steel production. In 2022, in order to fuel its output, the nation bought 1.1 billion tons of iron ore, 65% of which it imported from Australia. The country also uses a great deal of copper or that it imports from 59 different countries. Chile, Peru, Mexico, Mongolia, and Kazakhstan, are its five largest sources. Even the US benefits from industrial growth in China. Of the $151.1 billion of US exports that went to China in 2021, $36.1 billion worth was in the form of commodities, while agricultural products totaled $31.6 billion.

It’s this ‘tide that lifts all boats’ mindset that is responsible for companies that have fairly little exposure to China Also seeing a nice increase in share price in response to the news. One example of this can be seen by looking at Freeport-McMoRan (FCX). You would think that, with 37% of the company’s copper production and 99% of its gold production coming from Indonesia, which is in close proximity to China, that a great deal of its revenue would be attributable to the country. However, only 4.1% of its revenue last year came from the world’s second largest economy.

Takeaway

Right now, China is facing a problem that is essentially the exact opposite of what the US has been phasing. Here in the US, the economy is so strong that inflation is a real problem. That is the case in many other parts of the world. But China, because of its prolonged economic shut down, is struggling to pick up the pace. There are some bright spots. But there are a lot of pain points as well. The results reported by the country and by other parties impact countless millions of lives. For instance, the urban jobless rate in the country stands at a rather lofty 5.2%. Amongst those aged 16 to 24, 20.4% are currently unemployed. If the economy can’t get moving on its own, the government must intervene. Otherwise, it risks creating a painful cycle that will only weaken growth and, potentially, even push growth into negative territory. This is a great first step by the country’s leaders. And while China should hopefully be the primary beneficiary of this maneuver, the ripple effects are already being reflected in higher share prices of the companies that stand to benefit the most and ETFs like XLB that hold those firms.

Read the full article here