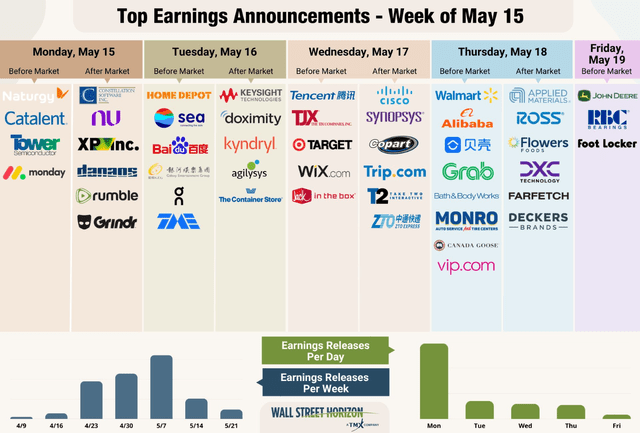

Earnings season presses on. One more significant week of quarterly reports takes place, mainly from the retail industry. The Energy sector has largely issued its collective Q1 results.

One foreign name, YPF Sociedad Anónima (NYSE:YPF) issued first-quarter earnings last Friday, and the numbers were decent, but its stock fell. I reiterate my buy rating even as global oil prices turn soft.

This Week’s Earnings Calendar

Wall Street Horizon

According to Bank of America Global Research, YPF is an integrated oil company with operations in exploration & production, refining, distribution, and petrochemicals that are expected to see better trends over the next several years. The company has total oil and gas reserves of 1,043mn boe (56% oil) and total production of 511tboepd in 2020 (53% oil/NGLs). Virtually all of its operations are in Argentina.

The Buenos Aires-based $9.2 billion market cap Integrated Oil and Gas industry company within the Energy sector trades at a low 2.0 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

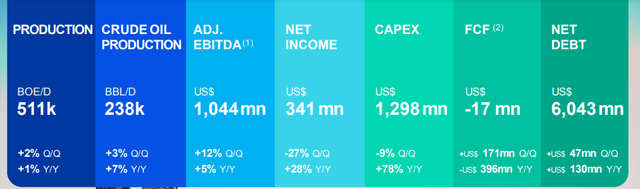

YPF reported a bottom-line beat last week, earning $0.87 of EPS, topping analysts’ estimates by three cents. Revenue verified up nearly 13% year-on-year at $4.24 billion, a $10 million beat. Growing oil production and higher processing rates drove the solid results.

Specifically, shale production grew 31% from a year ago with shale natural gas rising 9% – both of which are in line with what YPF is expecting in 2023. Overall, Q1 EBITDA was about what analysts were expecting.

YPF Q1 Operational Highlights

YPF

A key risk for the company’s operations is a further deterioration in gas and power prices in Argentina – EBITDA was negative last quarter for that segment – a significant sequential drop from Q4 2022. An encouraging sign in my view, though, is that the CEO said back in April that the company plans capex spending of up to $7 billion to increase net exports. This comes after Q4 net margins notched records.

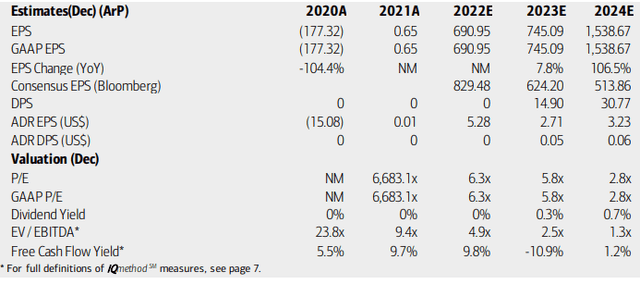

On valuation, analysts at BofA see earnings rising sharply this year with an acceleration in per-share profits in 2024. Dividends are expected to commence on the stock in the coming quarters, but slightly negative free cash flow, care of capex that was up 78% from year-ago levels, reported in the first quarter is likely not strong enough to warrant payouts to shareholders.

Still, earnings available to US investors via the ADR shares are seen as bouncing back in ’24 after this year’s dip and after 2022’s strong commodities market. Both YPF’s operating and GAAP P/Es appear attractive, but a significant country discount should be applied to this Argentine firm.

YPF: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

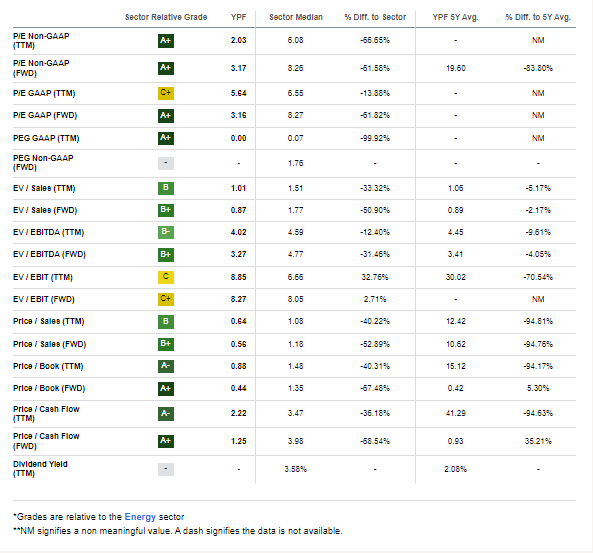

I still see value in YPF shares despite an ongoing share price consolidation. Considering that the company has traded at an average forward operating earnings multiple near 20, today’s 3.2x figure is exceptionally low.

If we assume NTM non-GAAP EPS of $2.90 with a heavily discounted 5x multiple, then shares should be near $14.50. That multiple is figured assuming a near-double in the discount rate compared to the market’s (high single digits), thus a roughly 50% discount to the Energy sector’s forward operating P/E.

YPF: Strong Valuation Situation, Mindful of the Country Discount

Seeking Alpha

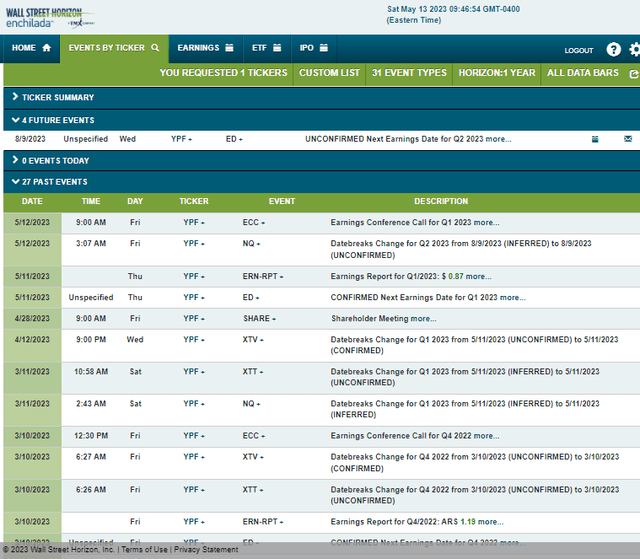

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Wednesday, August 9 BMO. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

Wall Street Horizon

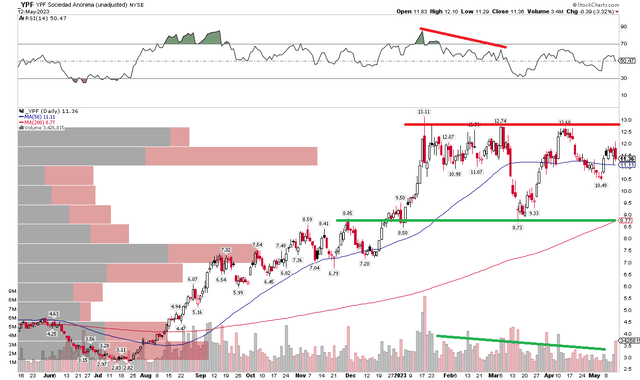

The Technical Take

YPF is in a bullish consolidation mode. Notice in the chart below that shares held support just under $9 during its steep March drop. The prior range’s highs of in the mid to upper $8s was defended successfully. Today, the rising 200-day moving average comes into play at the same mark. Also notice that bearish RSI divergence portended the price drop, but that has since resolved itself.

I am not encouraged by Friday’s high-volume bearish engulfing candlestick pattern, but a close above $13 would suggest a bullish measured move price target to near $17 based on the current $4 range. Long with a stop under $8 make sense, though risk-conscious investors might choose to place a stop under the May low of $10.49.

YPF: A Sideways Trade Following A Major Rally

Stockcharts.com

The Bottom Line

Despite sagging oil and gas prices, I reiterate my buy rating on YPF. Shares are undervalued in my eye while the chart is simply in a consolidation phase.

Read the full article here