Overview

I continue to think that Yum China (NYSE:YUMC) deserves a buy rating. YUMC’s 1Q23 results showed another strong improvement in margin (net margin improved to 10.58% from 5.16% in 1Q22), and it’s worth noting that restaurant margins have now risen above the pre-covid level and are very close to setting a record high. What is more positive is that SSS is still below pre-covid levels, suggesting there is still further room for margin to expand purely on a normalized SSS basis. I expect the continuous enhancement of new store economics and store portfolio optimization (I have previously talked about this) to continue driving the strong margin profile going forward. Enhanced traffic and labor efficiencies contributed to higher profits alongside the reduced cost of food and other value promotions (as per 1Q23 earnings call). Given the macro environment, I believe the momentum in SSS recovery is very encouraging, which combined with management comments for FY23, makes it even more positive. Despite rising commodity and labor costs, the company is committed to its three core competencies—food innovation, supply chain management, and ongoing labor efficiency initiatives—as a means of weathering the storm. Overall, I am encouraged by YUMC stock’s performance this quarter and expect to see continued improvement moving forward.

Unit economics

Finally, after many quarters of recovering SSS back to pre-covid levels, YUMC is finally reaching the last stretch, with 1Q23 SSS back to 93% of 2019 level. Both KFC and Pizza Hut saw increases in same-store sales in 1Q23; KFC was up 8% and Pizza Hut was up 7%. I believe that YUMC’s emphasis on driving sales with value campaigns in the face of volatile macro conditions and low consumer confidence is largely responsible for this recovery’s success. I believe the focus on rolling out value campaigns was a smart strategy to gain share, as it addressed the key reason consumers are not willing to eat out: cost. While the gross margin might be impacted, I believe attracting volume and staying ahead of top-of-mind awareness are more important. In my opinion, this is evident from the 650 bps increase in restaurant margins, which can be attributed to COGS reductions, increased labor productivity, and rent cost operating leverage. The increase in traffic (and thus the higher rates of store and labor utilization) is what made all of this possible.

Demand trends

I anticipate YUMC’s SSS to continue to improve in the coming quarters, and there is a good chance it will finally surpass 2023 levels. Taking the current trajectory of demand into account, I find it highly probable. Importantly, the improvement in SSS was driven by transaction growth for both KFC and PH, with all dine-in, takeaway, and delivery growing. This broad-based growth/recovery shows that YUMC’s value campaign is successful across all touchpoints and that the company is not riding a wave of good fortune from a single channel. Management has also noted that customers’ focus on value has not wavered since the store reopened. Therefore, I believe it is smart that management continues to offer value products to ensure customers come back repeatedly, while also offering new innovative products should consumers trade up (raising spend per customer and SSS). In a normal setting, this would be tough on the supply chain and cost of goods sold (too many menu items), but this is where YUMC shined. Commodity prices were held down by supply chain efficiencies, menu innovation, and effective pricing. Overall, I agree with management that we should approach future growth with a healthy dose of skepticism. Unlike the huge increases seen during the Lunar New Year and Labor Day, the growth is likely to be slow and steady.

Valuation update

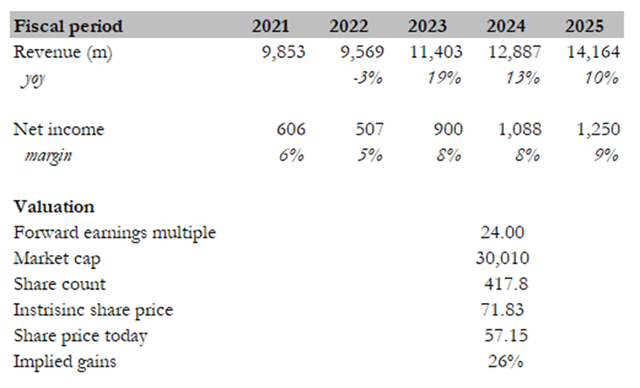

Today’s risk/reward situation is far more appealing than it was the last time I provided an update on YUMC. The stock was previously trading at 26 times forward earnings, and margin recovery was slower. This time, the margin is expected to be 9% in FY25 (based on consensus figures), up from 8% previously, resulting in a net income delta of around $100 million. Assuming the stock trades at the same multiple as it does now (24x forward earnings), I see a 26% upside. However, given the improved earnings growth outlook and improved business fundamentals, one could argue that the stock should trade back at 26x forward earnings, as it did previously. If the stock trades back to 26x, the upside becomes even more appealing at 36%.

Author’s estimates

Risks

Weak macroenvironment

The Chinese economy poses a macro-risk to YUMC. Especially in today’s environment, where the Chinese government is aggressively shutting down cities and states to contain the spread of COVID, regardless of what might happen to the economy in the short term. The saving grace here is that YUMC product offerings are largely affordable and can be delivered easily, cushioning the impact of lockdowns.

Competition from delivery platforms

To increase their user bases and significantly broaden and subsidize consumer choice, delivery platforms may provide considerable discounts to customers, thereby capturing market share from YUMC. This has occurred before when Alibaba and Meituan were vying for market share, but it has subsided recently due to the desire to make money (due to pressure from shareholders).

Conclusion

In conclusion, I maintain a positive outlook on YUMC and recommend a buy rating based on several factors. The company’s 1Q23 results showcased continued improvement in margins, with restaurant margins surpassing pre-COVID levels and approaching a record high. This is particularly noteworthy considering that SSS is still below pre-COVID levels, indicating room for further margin expansion on a normalized basis. YUMC’s focus on enhancing new store economics and store portfolio optimization, along with food innovation, supply chain management, and labor efficiency initiatives, has contributed to the strong margin profile. The recovery in SSS, driven by value campaigns and broad-based growth across dine-in, takeaway, and delivery, reinforces the success of YUMC’s strategies. Despite rising commodity and labor costs, the company remains committed to weathering challenges through its core competencies. From a valuation perspective, the risk/reward situation has improved, with potential upside ranging from 26% to 36% based on earnings growth and business fundamentals. Overall, YUMC’s performance and outlook are encouraging, supporting a buy recommendation.

Read the full article here