Investment Thesis

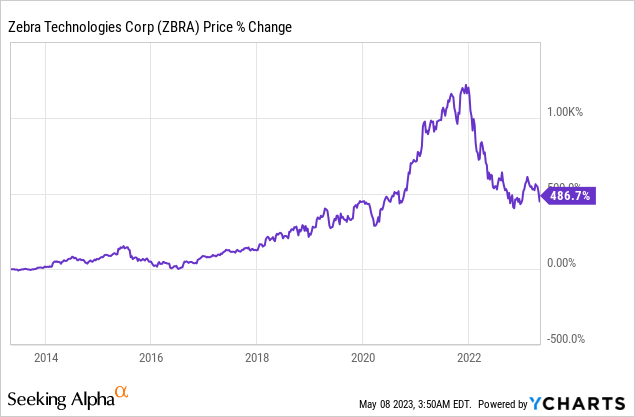

Zebra Technologies (NASDAQ:ZBRA) has been a great compounder in the past decade. Despite the recent pullback, its share price still rose nearly 500% during the period, vastly outperforming the broader indices. The company has been under pressure in the past two years due to macro headwinds such as elevated inflation and supply chain challenges, but I believe the weakness presents a great buying opportunity for patient investors.

The company’s fundamentals remain intact and it should continue to play an important role in digitization and automation. While the latest earnings were pretty weak, growth should start to rebound in FY24 due to easier comps and improved macro conditions. The current valuation is also very compressed and should offer meaningful upside potential if its financials improve. I like the risk-to-reward ratio at this price level therefore I rate the company as a buy.

Well-Positioned For Long Term Growth

Zebra Technologies is an Illinois-based company that specializes in digitization and automation solutions. The company provides products such as mobile computers, printers, scanners, and RFID to front-line workers of different businesses. It has a heavy presence in industries such as e-commerce, retail, logistics, and manufacturing. While the company is not that well-known, it actually has the leading market share in barcode printing, enterprise mobile computing, and barcode scanning.

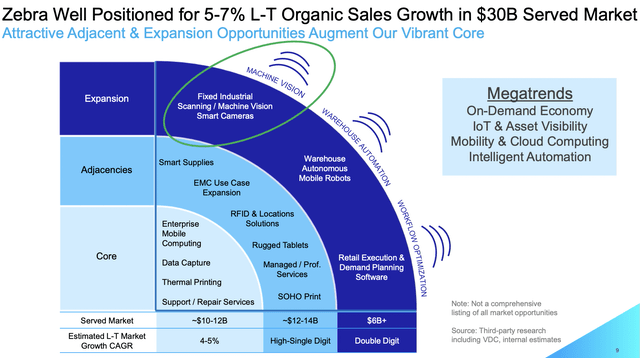

I believe Zebra Technologies should continue to see durable growth in the long run as it plays an important role in mega-trends such as supply chain digitization, manufacturing automation, and IoT (internet of things). For instance, the company’s products can be used for warehouse automation, asset tracking, inventory optimization, and more. These products allow businesses to cut down on labor and improve productivity and efficiency through better technologies.

The company’s product should see great long-term traction thanks to the rise of emerging industries like e-commerce, which presents a $15.6 trillion market, according to Grand View Research. According to the company, its TAM (total addressable market) is estimated to be approximately $30 billion with a solid long-term CAGR (compounded annual growth rate) of 5% to 7%.

Zebra Technologies

Q1 Earnings

Zebra Technologies announced its first-quarter earnings last week and the results are quite soft, as it continues to face increasing macro headwinds. The company reported net sales of $1.41 billion, down 1.9% YoY (year over year) compared to $1.43 billion. On an organic basis, net sales were down 0.3%.

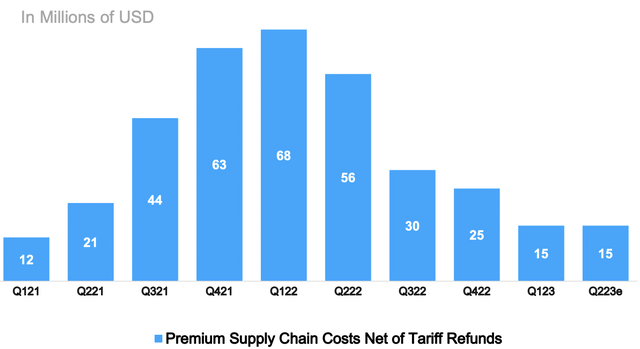

The drop was mostly attributed to the EVM (enterprise visibility & mobility) segment, which declined 11.2% from $1.04 billion to $914 million, accounting for 64.8% of total sales. The demand for mobile computers remains weak, as customers continue to tighten on spending. The decline was partially offset by the AIT (asset intelligence & tracking) segment, which increased 28.4% from $394 million to $491 million, accounting for 34.8% of total sales. The growth was mostly driven by the strength of its printing solutions, as supply constraints eased. The gross margin expanded 290 basis points from 44.6% to 47.5%, as the premium supply chain costs dropped 77.9% YoY, as shown in the chart below. This resulted in the gross profit up 4.7% from $638 million to $668 million.

Zebra Technologies

Spending remains elevated due to increased investments and S&M (sales and marketing) initiatives, partially offset by a decline in G&A (general and administrative) expenses. Adjusted operating expenses as a percentage of sales increased 130 basis points from 26% to 27.3%. The adjusted EBITDA increased 5.6% YoY from $285 million to $301 million, largely attributed to the increase in gross profit. The adjusted EBITDA margin also expanded 150 basis points from 19.9% to 21.4%. The non-GAAP net income declined 4.7% YoY from $214 million to $204 million, mainly due to increased interest expenses and higher tax rates. The non-GAAP diluted EPS was $3.94 compared to $4.01, down 1.7% YoY.

The company also lowered its full-year guidance amid softer-than-expected demand, as customer spending continues to slow. Revenue is now expected to decline by 2% to 6%, down from the range of a 3% decline to a 1% growth previously announced. The estimated free cash flow is also lowered from $650 million to $500 million, largely due to lower profitability and elevated inventory. While the guidance is disappointing, there may be a silver lining here. The lowered guidance now presents a much easier comp for FY24, which should see a meaningful rebound. According to Seeking Alpha, the company is now estimated to grow EPS and revenue by 14.5% and 6.5% respectively.

Valuation

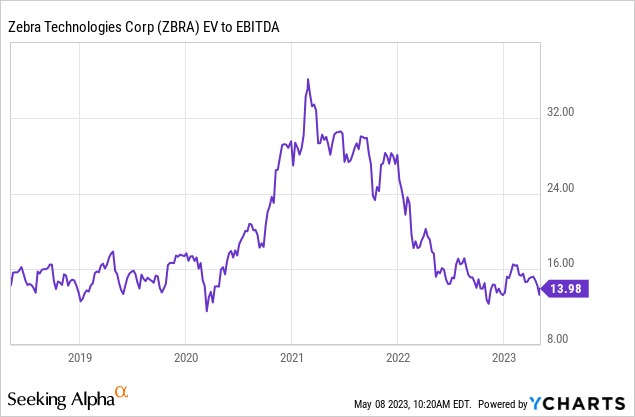

After the massive pullback, Zebra Technologies’ valuation is looking pretty attractive in my opinion. The company is currently trading at an EV/EBITDA ratio of 14x, which is discounted on a historical basis. As shown in the chart below, the current multiple is near the low end of its historical range, representing a significant discount of 35.7% compared to its 5-year average EV/EBITDA ratio of 19x. While the near-term valuation may remain compressed due to the lack of growth, I believe the company should see meaningful upside potential as financials are poised to rebound in FY24.

Investors Takeaway

While the near-term macro condition may remain dire, I believe investors should look past FY23 and focus more on Zebra Technologies’ long-term growth opportunities. The company has a leading market share in multiple products and is well-positioned to benefit from ongoing trends such as digitization and automation. The latest guidance was pretty disappointing but it also provides a much easier comp for FY24, as mentioned above. The current valuation is quite discounted and should present decent upside potential as growth improves in the coming year. Therefore I rate the company as a buy.

Read the full article here