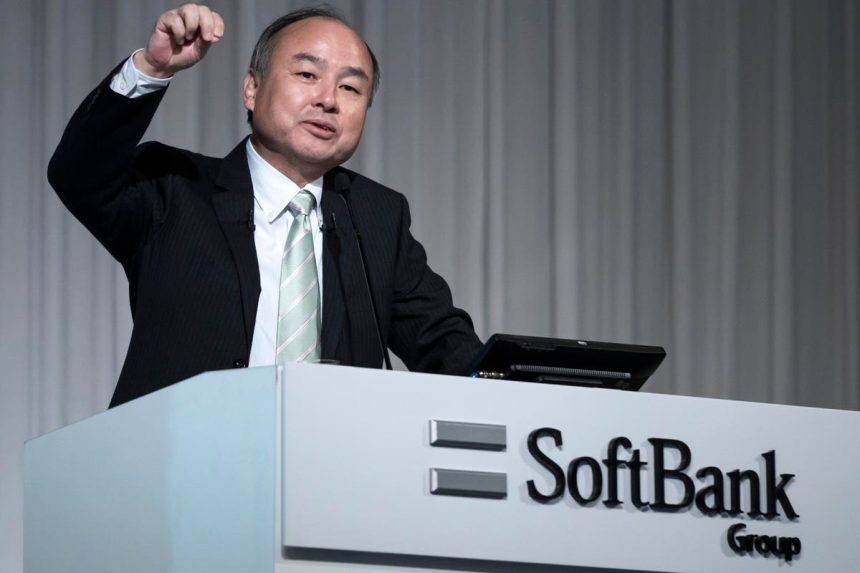

The Internet has been a major source of unicorns for entrepreneurs and VC, and artificial intelligence (AI) is expected to do the same. Even Masayoshi Son of Softbank is said to be eyeing AI after licking his wounds from a $32 billion loss. His firm is wondering whether they should adopt a more aggressive VC funding role in the emerging field of AI. According to his CFO, Yoshimitsu Goto, they are evaluating AI technology to decide if they should “just keep in defense or should we keep a balance with offense?”

VCs in Silicon Valley and elsewhere are expanding their investment in AI by a factor of 10x in the last 5 years.

The common assumption is that AI will create unicorns just as the Internet has been doing for the last 30 years – with ChatGPT being considered as just the tip of the bonanza. But will this happen?

Here is the key reason why AI will be tougher for entrepreneurs and VCs.

Revolutionary v. Evolutionary

The Internet was a revolutionary technology that made existing business models obsolete. It allowed, and often required, new business models, skills, and assets to do old things. The Internet helped new ventures with new business models to destroy giant corporations because it made existing assets, business models, and skills obsolete:

· Amazon.com: Bezos could enter online retail and get a competitive edge over established giants such as Borders and Barnes & Noble because he could sell a wider array of books, sell it for less due to the ability to sell without a store, and excel online because the existing giants did not know how to sell online.

· Netflix: Hastings used online streaming via the Internet, and the lack of late fees in his business model, to dominate and beat Blockbuster, which was hobbled by its existing investment in physical stores, unwillingness to eliminate late fees, obsolete skills in physical retail, and executives who did not get the threat.

· Airbnb: Chesky got an edge over the established hotel giants because he could use the Internet to help anyone rent their home or rooms in their home. The existing giants could not jeopardize their own investments, or their affiliates’ investments, in existing hotels.

This is similar to personal computers, which was a previous revolutionary technology. PC companies destroyed many giants in the old mainframe computer industry, such as Control Data and IBM, because PCs allowed a new business model where anyone could assemble and sell PCs without the need for capital-intensive manufacturing or human-intensive infrastructure. PCs also opened new markets such as small businesses and consumers where the existing giants were not competitive. The new markets had different needs and needed a new business model including software and hardware.

But AI is different. Rather than being a revolutionary technology often requiring, and allowing, new business models with significant advantages that can destroy the old ones, AI is more evolutionary and allows existing corporations to improve their edge with current assets, products, services, organizations, and skills. Even though AI has extraordinary potential, it is an evolutionary innovation and makes existing businesses more competitive. IBM’s chief commercial officer notes that “AI may not replace managers, but the managers that use AI will replace the managers that do not.”

AI Unicorns will be Tougher.

This means that it will be tougher for entrepreneurs to build unicorns and VCs to finance them to replace the old giants. They may build companies in niche markets that they can then flip to the existing giants, or they may come up with better products that may be acquired by existing giants, or they may build new tools that become unicorns. But it will be tougher to replace the old giants. So, this evolutionary innovation will not be a slam dunk for VCs, and Son will face a tougher challenge from existing companies that can add AI to their product line and operations.

MY TAKE: Those who do not understand the difference between evolutionary and revolutionary technologies will pay the price in the emerging AI trend. VCs and entrepreneurs will find that they will not replace the existing giants but will have to find growth where the existing giants cannot, or do not, easily, enter.

Read the full article here